How the Opendoor IPO Impacts the Future of Real Estate

The recent $4.8 billion Opendoor IPO ensures that iBuyers and “proptech” will be a force in real estate for years to come.

With an initial public offering (IPO) raising an estimated $4.8 billion, Opendoor recently brought mainstream media attention to real estate technology. As one of the largest iBuyers, Opendoor provides homeowners an off-market way to sell their house quickly without a real estate agent.

One of the largest “proptech” (property technology) IPOs ever, this is a milestone event that gives Opendoor the power to attract huge investments. It also makes a significant statement about the real estate industry.

In fact, the IPO not only affirms that sellers don’t have to go the traditional route anymore when selling their home, but that business is booming. Such success paves the way for the growth of other real estate disruptors.

Setting the tone for off-market buying and selling

Opendoor going public solidifies a spot for off-market buyers in the real estate market. As a company whose business model allows consumers to buy and sell homes online, Opendoor does away with the need for agents, finding buyers, and making repairs. The company’s readiness to go public will only enhance innovation in real estate technology. Put another way, iBuyers are here to stay.

Legitimizing alternative ways to buy and sell houses

It’s been a while since a real estate tech startup had an IPO. The last two that did so were Redfin (2017) and Zillow (2011).

Since going public, Zillow has added an iBuyer service to its business. Redfin also buys and sells homes in certain markets.

While many iBuyer purchases come in below market prices, the speed at which they move is attractive to many customers. Add how easy it is for owners to get an offer, and it’s clear why so many people are turning to this alternative form of selling.

The Opendoor IPO takes this trend public for the first time in a unique way. Unlike Zillow and Redfin, Opendoor’s primary business model is iBuying.

How big is Opendoor today?

Debuting as a public company with a nearly $5 billion valuation is no small feat. Opendoor has a huge chunk of the iBuyer market, with more than 32,000 home purchases since 2017. Opendoor currently has offices in 12 states, but purchases houses in at least 16 states.

In recent years, the number of homes sold in the U.S. annually has been around 5 million. Of that, an estimated 5% to 10% were sold off market. With an estimated 87% of homes still sold the traditional way with a real estate agent, the opportunity for iBuyers to further cut into this market is enormous.

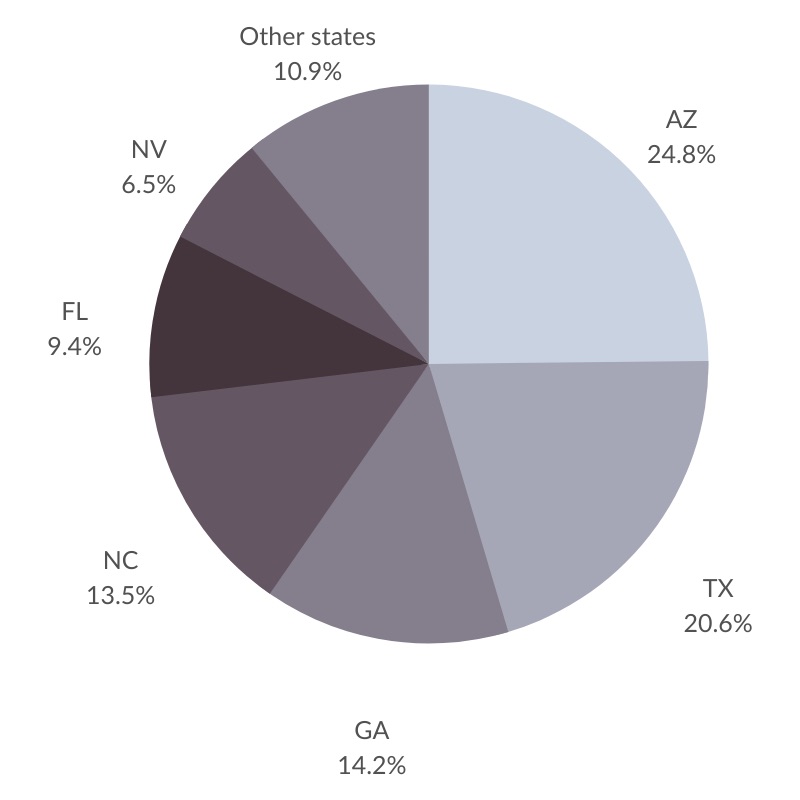

Opendoor started its business in Phoenix and gradually added new markets over the past three years. About three quarters of Opendoor’s home purchases since 2017 came in just four states (Arizona, Texas, Georgia, and North Carolina).

Opendoor home purchases by state

In the past three plus years, the median price of Opendoor’s deals came in higher than the state median sale price in nearly every state in which they operate (see table below). This reflects the company’s focus on homes already in market ready condition that can be turned and sold quickly.

| State | Median Opendoor Sale Price | State Median Sale Price | Percent of State Median | Difference |

|---|---|---|---|---|

| California | $403,000 | $480,000 | 83.9% | -16.1% |

| Colorado | $375,000 | $355,000 | 105.6% | +5.6% |

| Oregon | $375,000 | $317,000 | 118.3% | +18.3% |

| Utah | $398,350 | $309,800 | 128.6% | +28.6% |

| Nevada | $282,000 | $281,575 | 100.2% | +0.2% |

| Arizona | $248,000 | $245,000 | 101.2% | +1.2% |

| Texas | $235,250 | $233,100 | 100.9% | +0.9% |

| Minnesota | $279,500 | $220,000 | 127.0% | +27.0% |

| Florida | $240,000 | $205,000 | 117.1% | +17.1% |

| Georgia | $217,000 | $185,000 | 117.3% | +17.3% |

| North Carolina | $231,000 | $182,000 | 126.9% | +26.9% |

| Tennessee | $246,500 | $165,000 | 149.4% | +49.4% |

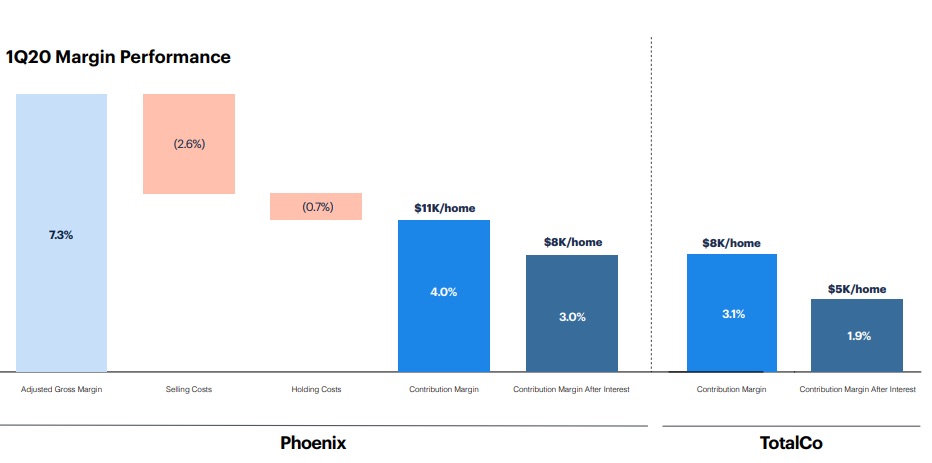

Opendoor’s average profit on every home is about $5,000. In its most mature market in Phoenix, the profit margin is $8,000. With median home sale prices ranging from $165,000 up to $480,000, this is a relatively thin profit margin (see image below).

Challenging the use of agents

The message of Opendoor’s IPO speaks directly to real estate agents. Even operating at a low profit margin, companies like Opendoor are making strong inroads into the industry. With smaller profits per home, median purchase prices aren’t that far away from what’s happening in the market.

In a world where iBuyers are getting the job done, in less time, at a competitive price, are real estate agents still necessary? If the answer is no, the success of Opendoor and similar proptech companies presents an enormous challenge to agents.

Top performers will be the ones that step up their game and provide services in a different way. Most importantly, those who provide the best customer service are likely to emerge as the industry leaders of tomorrow.

Relentless customer service is winning the day

When it comes to selling a home, nothing creates more frustration than waiting for the sale. It takes time to sell a home. It takes time to ready a home for sale. Staging, repairs, photos, and marketing all take time (and money). If results aren’t seen soon enough, sellers get frustrated. They often blame the agent.

Off-market buying eliminates this frustration. The level of customer service and customer satisfaction rises immediately when sellers realize they don’t have to show their home or make repairs. When off-market buyers purchase homes “as is,” they shave time off the selling process, allowing sellers freedom to pursue whatever is next. The result is happy customers.

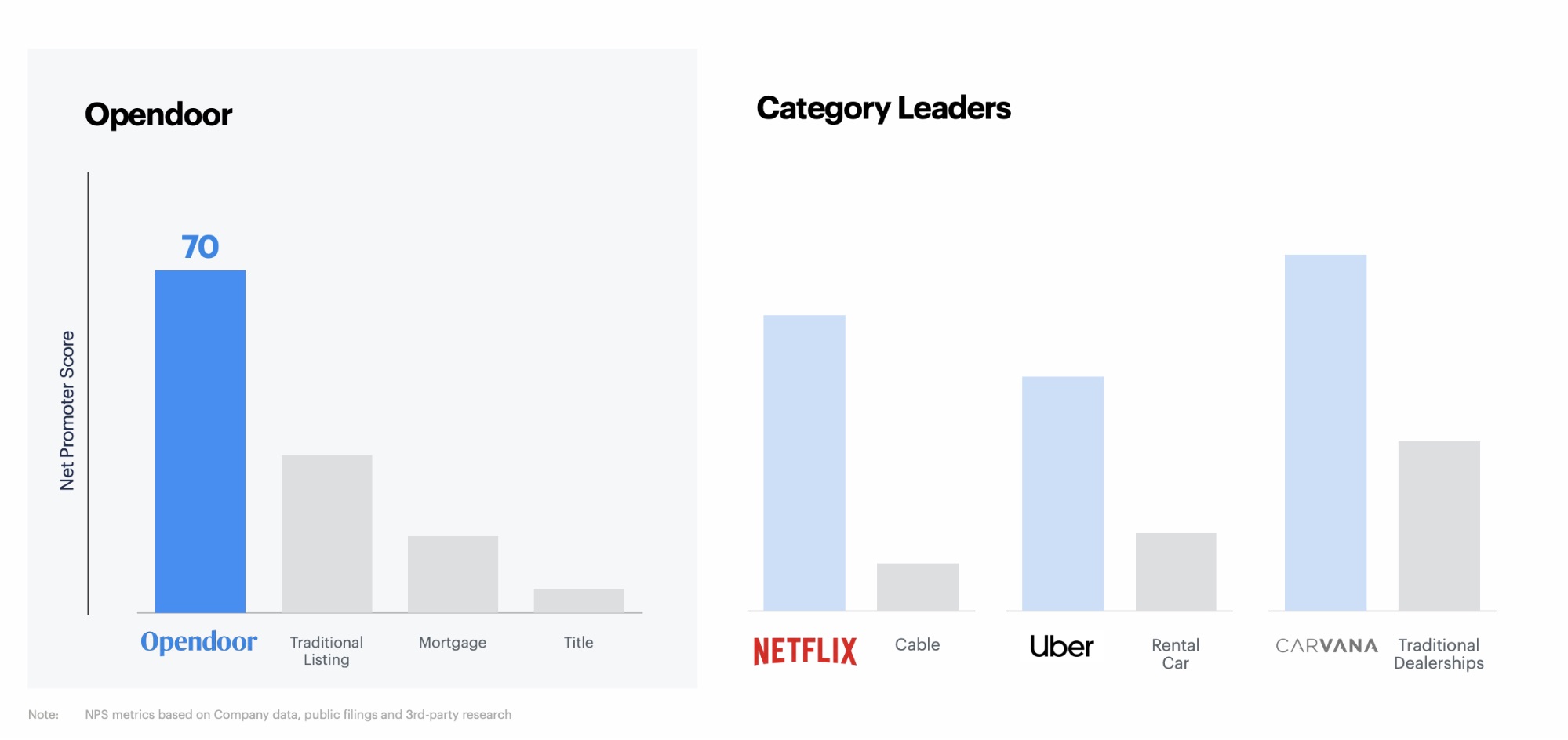

Opendoor’s IPO is proof that this approach works. Like similar category leaders in other industries, Opendoor touts a high Net Promoter Score (NPS). NPS is a proxy for customer satisfaction, as the higher the score, the more customers say they would recommend a company’s product or service.

The off-market model is working

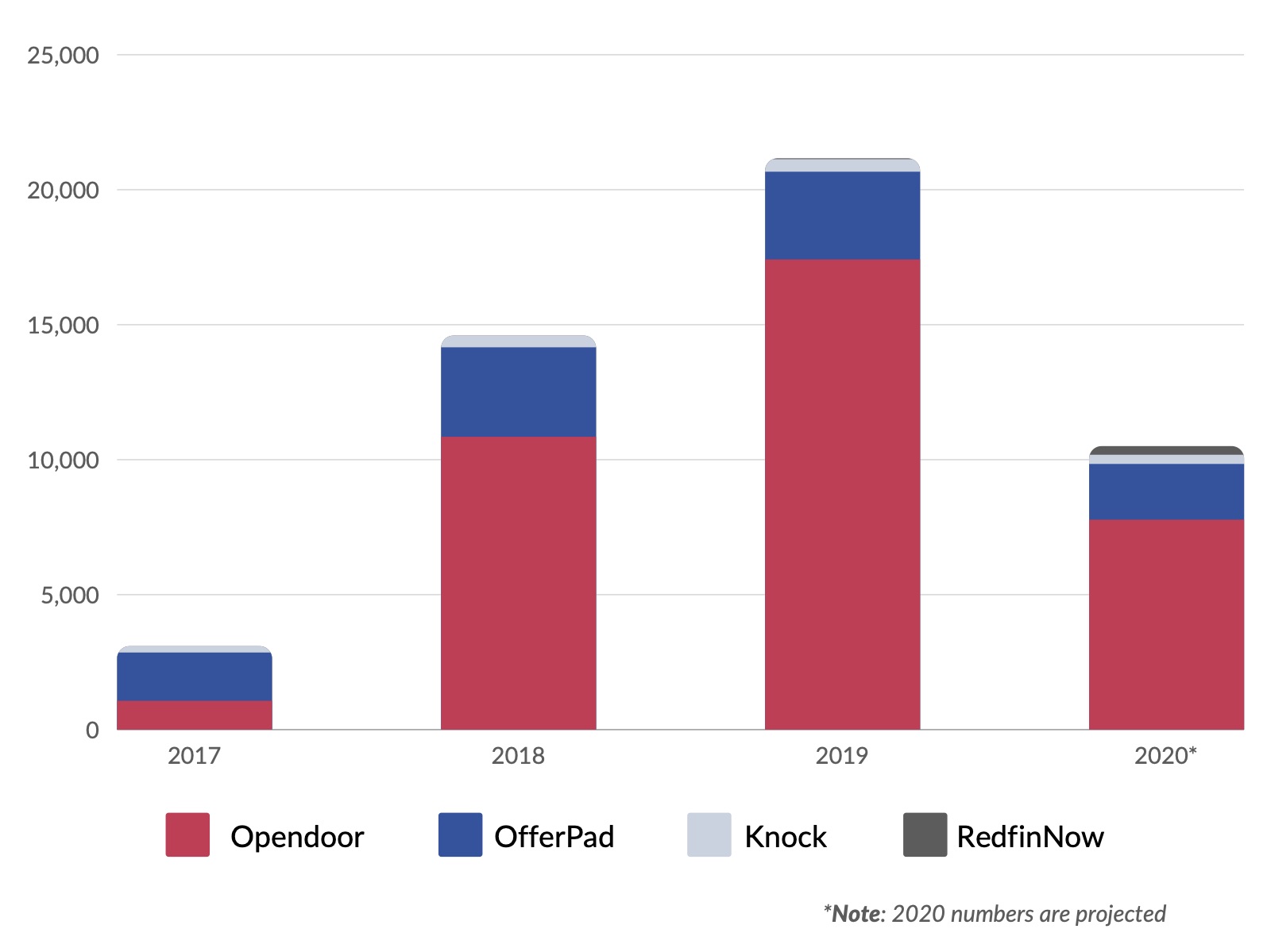

Opendoor may be the first IPO in a while, but it’s probably not the last. iBuyer home purchases are making a significant dent in the housing market.

iBuyer homes purchased annually since 2017

Opendoor is making a splash because of its ability to offer services beyond the typical iBuyer. This also helps differentiate the company from real estate agents, establishing Opendoor as a one-stop-shop for sellers.

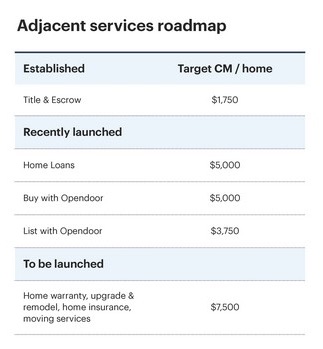

Opendoor offers, or will soon offer, services related to title and escrow, home loans, insurance, and home warranties (see below).

Where Sundae fits in

Sundae puts its focus on solving each customer’s problem, while providing a fair price and transparency into how we got there.

While each off-market buyer does things differently, the model itself is growing. Perhaps the primary takeaway from the Opendoor IPO is that sellers have more options than ever before. And, these are options are becoming more popular than working with real estate agents.

Note: Some images for this article were pulled from Opendoor’s Investor Presentation.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.