7 Ways for Homeowners to Thrive in a Downturn

Though the U.S. boasts the world’s most powerful economy, history on occasion brings economic downturns. Today, the society-wide fallout from the COVID-19 outbreak has many homeowners concerned about bad times on the horizon.

When economic activity declines, house prices often drop, which can cause homeowners to lose equity. In a worst case scenario, owners owe more than their home is worth, leading to foreclosure or bankruptcy.

With the right attitude and outlook, it’s possible for homeowners to weather the storm of a downturn. Here are some ways to help get through this challenging time.

1. Don’t make a hasty move

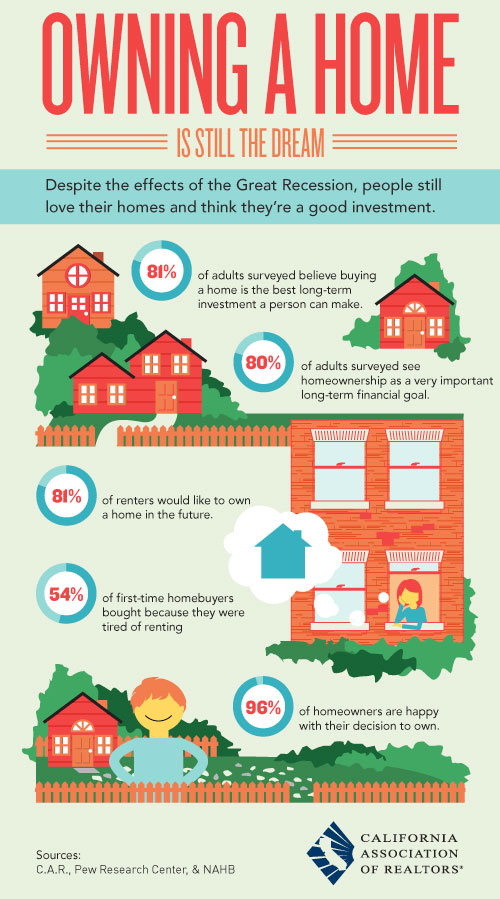

Even in the face of high unemployment, low consumer confidence, stock market volatility, it’s nice to know that most homebuyers remain optimistic. According to the California Association of Realtors, 81 percent of adults believe owning a home is the best long-term investment a person can make. Further, 96 percent of homeowners are happy with their decision to own a home (see infographic below).

Remember that downturns are a temporary part of the economic cycle. In tough times, home values can decrease, which will make it harder to sell your house in the short term. But these changes aren’t permanent. In fact, an economic slowdown is a signal to hold onto your property, be patient, and spend an increased focus on maintaining your home. When the housing market returns to health, which it will, you’ll be ready to pounce on more favorable conditions if you want to make a sale.

2. Refinance your mortgage

Deciding to hold onto your home and ride out an economic downturn doesn’t mean you can’t take advantage of financial breaks offered during this time. Just don’t jump on the first deal you see without reading the fine print. Low mortgage rates make it a great time to refinance and bring down your monthly payments. But make sure your new rate is fixed. Understand what upfront costs you’ll have to pay to make this change.

Beware, a new home loan can cost you thousands of dollars in fees. Bad choices can also decrease your potential savings. Before green-lighting any changes, think about how long you’ll stay in your home, the overall savings a refinance will give you, and whether or not you’re really getting a good deal.

3. Reduce expenses

Another way to make it more affordable to stay in your home is to cut costs elsewhere. Create a monthly budget that ensures you’ll have the money to cover your mortgage. Attempt to reduce your monthly spending by cutting subscription services you don’t regularly use and being more energy efficient. Take shorter showers and only wash full laundry loads to conserve water. Unplug electronics when not in use to conserve electricity. Use energy-efficient light bulbs. Cook more, eat out less. Exercise at home instead of at the gym.

4. Create a long-term plan

Time is a significant factor when it comes to owning a home. The longer you stay put, the more time you have to watch for optimal selling conditions. Decide when the time is right, whether it means waiting for your home to reach a certain value, having enough equity to turn a profit, or using another financial marker. Setting these types of goals as a homeowner helps establish your long-term plan.

Think about not only what you want to get out of your current home, but where you’ll go next, and how much money you’ll need to get there. Focusing on the long game can make it easier to get through a downturn. Questions to ask yourself include:

- How long do you want to stay in your house, ideally?

- Where do you want to live after you leave?

- When will you pay off your house?

- What would you like to do with the house ultimately?

- How much money do you need/want from a sale?

5. Invest in improving your home

Adding value to your home with some low-key improvement projects can really make a difference when it’s time to sell. Even if property values temporarily go down, a few renovation projects can keep your mind off the economy and add value to your home down the road. It you’re able, consider these low cost home upgrades:

- Update light fixtures

- Change accent hardware like faucets and doorknobs

- Paint a few rooms

- Install flower beds or yard improvements

- Complete any small repairs that have been lingering

Projects like these are cheap to do and may yield returns when you sell your home. Focus on minor updates instead of full remodeling projects or putting new additions on your home. As you begin updating, maintain aesthetic value and aim for neutral and classical colors and styles, which appeal to a larger number of buyers and support a higher resale value.

6. Diversify your investments

While it sounds counterintuitive to invest in real estate during an economic downturn, it may be a smart decision. The strongest buyer’s markets often emerge during recessions. Finding low-priced opportunities to buy properties with desirable characteristics is the key. Understand your expenses in owning the property, whether you’re buying it to fix and flip, or if you want to hold onto it and rent. There are pros and cons to each of these choices. For example, renting out property during a downturn gives you a secondary source of income. Rent payments are consistent and don’t fluctuate with the stock market. But you’ll still have to deal with tenants. Figure out what’s best for your situation.

7. Monetize your house

Consider putting your home to work for you. Is there an opportunity to rent out a room in your house for cash? If you live in a good location for renters, earn some money with an unused guest room, finished basement, or in-law suite. For urban dwellers, it’s possible to rent out a spot in your driveway as a parking space. Research parking apps that allow you to put up a space for rent. Consider renting out unused storage space through an app like Neighbor.

Finally, if the burden of owning a home during an economic downturn becomes too heavy, selling your house is a viable option. Prices may not be as high as in a better economy, but there’s still opportunity to walk away ahead. Even if the market feels unstable to list your house, you can work with an off-market buyer or sell through Sundae’s marketplace for homes that need repairs. Fill out our online form to learn more.

—

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.