Best Cities With Healthcare and Life Sciences Industries

Residents are fleeing many cities during COVID-19, but these cities with strong healthcare and life sciences industries will remain attractive markets to live in.

The performance of the residential real estate market was always largely determined by households’ ability to earn enough income to purchase a property. Good jobs mean more demand for houses.

Each geography has its own industries and sectors that fuel its local economy. The most diverse regions are the most resilient in economic downturns.

But while most industries follow changes in consumer demand, there are some bright spots in the post-pandemic world.

Healthcare and life sciences industries (including biotech and big pharma) outperform other sectors because of today’s increased interest in medicine and health. As a result, cities with high concentration of life sciences investment have potential to weather a downturn in residential real estate.

Growth in the life sciences industry

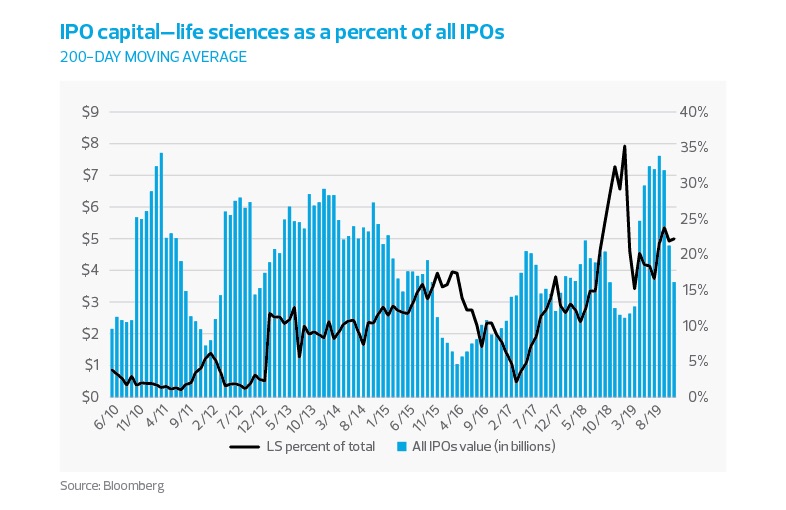

Despite the recession, life sciences in both public markets and private investment show signs of strength. Venture capital investments in the healthcare industry approached $12.3B in the first half of 2020, likely to outpace $16.7B invested for all of 2019 by far.

During the peak of the COVID-19 crisis, eight out of nine companies that went public on U.S. stock exchanges were life sciences companies. In the same period, 14 out of 21 U.S. companies that announced plans to IPO were from the life sciences sector.

As of August 2020, the total value of U.S. listed biotech IPOs was nearly $10B.

Best life sciences hubs

Successful expansion of a healthy life sciences sector depends on a multitude of key factors:

- A substantive life science workforce

- Educational institutions providing life science graduates

- Solid VC and NIH funding

- Medical research and health services institutions

- Strong concentration of high-tech workers

- Extensive inventory of commercial space with laboratory components

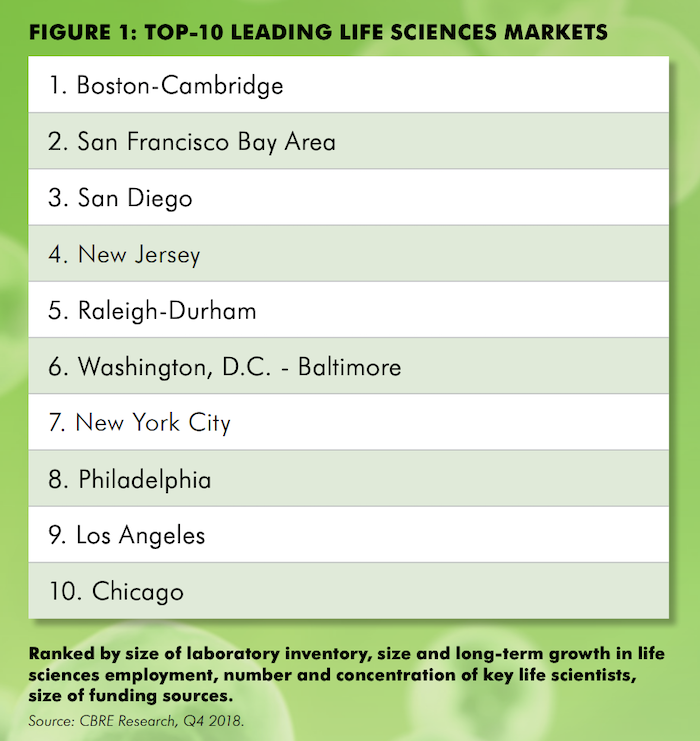

CBRE standardized each of these factors, helping compare markets to one another. Several markets emerged to the top of the heap.

Boston-Cambridge and the San Francisco Bay Area are ahead with dynamic life sciences markets poised for growth. Another strong market is San Diego followed by Raleigh-Durham, the state of New Jersey, and the Washington, D.C – Baltimore area.

While budding hubs are emerging in other parts of the U.S., talent scarcity forces companies to seek presence first in markets with largest talent pools.

It’s all about the talent pool

With rapid growth of the industry, demand for talent outpaces supply.

Using Boston as an example, a report released in June by the Massachusetts Biotechnology Education Foundation stated that there was a 35% increase in life sciences jobs over the past decade.

Meanwhile the demand for PhD job candidates grew 140% from 2010 to now with no measurable increase in life sciences PhD conferrals. And the demand for candidates with a Bachelor’s degree grew 120%, with only a 37% increase in graduates.

Just 11 metros represent two-thirds of life sciences jobs. Boston-Cambridge, the San Francisco Bay Area, and San Diego are home to most of them by far.

Sweet spot alternative

Many companies are resilient and quickly adapted to maintaining employee productivity amid COVID, resulting in better job stability.

Cost savings associated with not having office space (and the bills that come with maintaining it) led to announcements from tech companies like Twitter and Facebook about permanent work from home. The real surprise was news about Nationwide Insurance shutting its five regional offices because the shift to working from home during the pandemic has gone so well.

Working from home entirely, however, isn’t popular with bosses or workers. The prevailing solution for the moment appears to be a hybrid home-and office-work model. In this arrangement, workers split their week between individual work in the comfort of home and face-to-face collaboration in an office setting.

This sweet spot, according to Global Workplace Analytics, will save the typical employer $11,000 a year for every employee who works remotely half of the time.

Another upside for employees, they can save between $2,500 and $4,000 a year working remotely half time. Thus, full abandonment of office space is highly unlikely.

Remote work is impossible for life sciences

Choice of location limits the life sciences industry. Businesses go where lab space accommodates their operations and provides a labor force to work in their labs.

This sector is less likely to follow other industries that are downsizing office space as more employees work remotely. Unlike with tech and finance jobs, mass telecommuting is impractical in an industry that requires laboratory work and brainstorming.

Biotech is more likely than other industries to relocate executives and scientists from other states. “Remote work does not really work for a lab-based employee,’’ said Michael Gilman, CEO of Arrakis Therapeutics, a Waltham biotech.

Commercial real estate brokers anticipate increased demand for biotech space in the short run.

According to William Hartman, an executive managing director at Cushman and Wakefield, in late May he knew of 15 to 20 firms looking for life sciences space in New York City. “Almost without exception, everyone’s moving as fast as they can forward,” he said.

Established companies had to stop most non-COVID related clinical trials. Some sales and marketing jobs are at risk because doctors don’t want to meet with reps and patients.

What’s next for healthcare and life sciences hubs?

“Pharma will persevere and come out stronger on the other end, but what it’s going to look like is still unclear,” said Yana Volman, VP Access Strategy. Volman supports more than 30 biopharma companies at Coeus Consulting Group. She said her large clients are budget conscious and only spend what they have to at the moment.

“While sales and marketing jobs can technically be done from home, they are nomadic and might migrate,” she said. “But they won’t follow real estate prices. They’ll follow jobs in biotech concentrated areas.”

For now, where biotechs seem to want to be is in close proximity to scalable talent, academic research institutions, and the attention of venture capital investors. That’s not likely to change anytime soon.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.