How COVID-19 Has Impacted Mortgage Payments in Every State

Discover what programs (if any) state governments have rolled out for financial housing assistance and how homeowners in your state are faring.

More than 2.1 million Americans were in forbearance plans in mid-May 2021, according to a recent Mortgage Bankers Association’s Forbearance and Call Volume Survey. One in every 4,078 housing units underwent a foreclosure filing in the first quarter of 2021; by the second quarter, those numbers were down with 223,671 properties in the process of foreclosure nationally, according to ATTOM Data Solutions’ 2021 Vacant Property and Zombie Foreclosure Report.

The Federal Housing Administration on June 25 announced additional help for homeowners struggling to make their mortgage payments. This assistance includes extending the federal foreclosure and eviction moratoria for all FHA-insured, single-family mortgages along with extended COVID-19 forbearance request timeframes and a new home-retention option called the COVID-19 Advance Loan Modification (COVID-19 ALM), available to borrowers who are 90-plus days past due or who have reached the end of their COVID-19 forbearance.

In addition to federal assistance, many major mortgage lenders including, Wells Fargo and Bank of America, temporarily suspended foreclosures. Other, smaller banks around the country similarly suspended evictions and foreclosures in late spring. The Consumer Financial Protection Bureau (CFPB) is expected to adopt a rule by August that would require mortgage servicers to allow homeowners until the end of 2021 to pick back up on payments.

Sundae analyzed state data from the U.S. Census Household Pulse Survey that tracked if respondents are caught up with their mortgage payments. To understand how the economic impacts of COVID-19 affected homeowners’ mortgage payments, Sundae compared the most recently available data collected during May 12–24, 2021, and data collected during April 23–May 5, 2020. Sundae also calculated the percent of households who lost income and fell behind on mortgages, and the percent of unemployed residents who fell behind on payments. Each data point also includes the state ranking.

Struggling homeowners have fared better than renters overall, with data showing quicker recovery for those with mortgages due to factors such as low-interest rates and homeowners receiving more protection than renters from the $2 trillion CARES Act. The Consumer Financial Protection Bureau offered another lifeline on June 28 by issuing a final ruling to amend Regulation X, instilling procedural safeguards for the time being to give borrowers full review over loss mitigation before lenders can start foreclosure proceedings on various mortgages.

Keep reading to discover what programs (if any) state governments have rolled out for additional assistance and how homeowners in your state are faring.

Related: The Myth of Forthcoming Foreclosures

Sean Pavone // Shutterstock

Alabama

– Households that report falling behind on mortgage payment: 18.6% (#45 highest, 10.9% less than in 2020)

– Households with lost income that fell behind on mortgage: 24.1% (#38 highest, 17.0% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 20.1% (#38 highest, 4.1% greater than in 2020)

The foreclosure program Hardest Hit Alabama, launched in 2010, reopened in June 2020 to help residents affected by the economic impact of COVID-19. Just 22% of households with children are confident in their abilities to pay their next rent or mortgage bill on time, according to a recent report by the Montgomery-based VOICES for Alabama’s Children.

Hardest Hit Alabama, which stopped accepting applications in March 2021, provided mortgage assistance up to $30,000 for those who have lost jobs or had their incomes reduced due to COVID-19. Eligibility requirements included a maximum household income of no more than $91,420 and a maximum unpaid principal of $300,000. Applicants also had to have not received prior mortgage assistance in Alabama and could not be in active bankruptcy. The program has provided upwards of $82 million in mortgage assistance since its founding.

Greg Browning // Shutterstock

Alaska

– Households that report falling behind on mortgage payment: 30.0% (#9 highest, 8.2% greater than in 2020)

– Households with lost income that fell behind on mortgage: 22.3% (#43 highest, 23.3% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 18.5% (#39 highest, 54.2% less than in 2020)

In June 2020, the Alaska Housing Finance Corp. provided rent and mortgage assistance in an effort to prevent homelessness among Alaskans whose incomes were affected by COVID-19. The assistance — a one-time payment of $1,200 distributed via lottery and made out directly to mortgage lenders or landlords — was made possible by the federal CARES Act. To apply, residents had to have lost their job or be making 80% less than the median income for the area where they reside. The assistance helped as many as 2,000 households in Alaska.

Sean Pavone // Shutterstock

Arizona

– Households that report falling behind on mortgage payment: 22.9% (#33 highest, 11.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 24.7% (#34 highest, 14.9% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 25.6% (#20 highest, 14.6% less than in 2020)

Tens of thousands of Arizonans have utilized emergency living assistance from the state and federal government since the spring of 2020, including eviction moratoriums. Just $50 million of the $850 million in rental and utility assistance sent to Arizona in 2021 had been dispersed by early June, according to reporting from Arizona Central. Half of Arizonan homeowners’ loans are backed by Fannie Mae or Freddie Mac.

shuttersv // Shutterstock

Arkansas

– Households that report falling behind on mortgage payment: 30.4% (#8 highest, 4.5% less than in 2020)

– Households with lost income that fell behind on mortgage: 58.3% (#2 highest, 241.0% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 26.6% (#18 highest, 30.3% greater than in 2020)

Arkansas has not rolled out any statewide foreclosure protection programs for residents. The utility disconnection moratorium, rolled out by the Arkansas Public Service Commission, ended May 3, 2021. The Central Arkansas Development Council offered temporary financial assistance in June 2020 to help qualified Arkansas residents with mortgage and rent payments. The program, following guidelines set by the Arkansas Low Income Home Energy Assistance Program, provided renters and homeowners in financial need with a maximum of $500 to use for mortgage or rental payments. It also offered a maximum benefit of $150 for Water Utility Assistance.

trekandshoot // Shutterstock

California

– Households that report falling behind on mortgage payment: 29.4% (#11 highest, 5.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 35.6% (#17 highest, 2.3% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 22.5% (#27 highest, 21.9% less than in 2020)

Homeowners in California who struggled to make mortgage payments during COVID-19 were eligible to apply for up to 90 days of forbearance without negative credit reporting, late charges, or fees. But with the effects of COVID-19 still bearing down almost a year and a half after the first shutdowns, much of the relief has dried up. Some landlords have avoided applying for aid for fear of hurting their credit. But even with national mortgage forbearance and $2.6 billion in statewide rental relief, many landlords in the state are left unable to meet the costs of their buildings’ mortgages.

Jaminnbenji // Shutterstock

Colorado

– Households that report falling behind on mortgage payment: 18.6% (#46 highest, 1.8% less than in 2020)

– Households with lost income that fell behind on mortgage: 13.0% (#48 highest, 32.4% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.3% (#30 highest, 15.7% less than in 2020)

The volume of Colorado residents requesting housing assistance was so high, the state Department of Local Affairs hired HORNE, a Mississippi-based emergency services contractor, to help with the backlog. As of mid-June 2021, the state had spent $6.5 million on these services so far, with 100 people working on cases at a clip of roughly 2,500 applications every two weeks with more requests coming in. As of June 1, Colorado has provided $85.6 million in monthly rent or mortgage payments to more than 33,000 households in the state since the start of the pandemic.

Christian Hinkle // Shutterstock

Connecticut

– Households that report falling behind on mortgage payment: 27.6% (#20 highest, 39.4% less than in 2020)

– Households with lost income that fell behind on mortgage: 41.2% (#9 highest, 27.1% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 38.9% (#5 highest, 279.7% greater than in 2020)

In Connecticut, whether or not people are struggling to pay their mortgages depends on where they live. In some areas, such as New Haven’s Hill neighborhood, the rate of homeowners behind on mortgage payments is disproportionately high. For the Southwest Connecticut region, 1 in 6 households with a Federal Housing Association mortgage—70% of Connecticut’s mortgages—were behind as of August 2021.

The state set up the Emergency Mortgage Assistance Program, which could help some households pay their mortgages for up to 60 months. Connecticut’s Community Renewal Team’s Community Services Block Grant offers up to $8,000 in mortgage payment assistance for homeowners in the greater Hartford and central Connecticut area. To qualify, mortgage holders’ household incomes can’t exceed 200% of the federal poverty level.

tokar // Shutterstock

Delaware

– Households that report falling behind on mortgage payment: 28.6% (#14 highest, 25.9% less than in 2020)

– Households with lost income that fell behind on mortgage: 34.8% (#18 highest, 11.6% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 17.3% (#41 highest, 53.3% less than in 2020)

Gov. John Carney is slated to lift Delaware’s State of Emergency Order on July 13, 2021. During the order, court and law enforcement officers and their agents have been barred from issuing foreclosures. The National Council on Agricultural Life and Labor Research Fund, Inc. (NCALL) has to date helped 49 Delaware families apply for mortgage assistance while the organization’s loan fund granted 90-day payment deferrals to 12 borrowers in the state. NCALL in 2020 saved more than $12 million in mortgages, with the average mortgage saved totaling $187,187. Delaware’s Emergency Mortgage Assistance Program has been paused as of at least June 2021.

Marchello74 // Shutterstock

Florida

– Households that report falling behind on mortgage payment: 27.8% (#18 highest, 10.5% greater than in 2020)

– Households with lost income that fell behind on mortgage: 34.7% (#19 highest, 31.1% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 35.1% (#7 highest, 29.3% greater than in 2020)

Florida has five areas deemed high-foreclosure areas, more than anywhere else in the country. The state had the third-highest foreclosure rate in Q1 2021, with one in every 2,237 housing units foreclosed on. Gov. Ron DeSantis extended Florida’s foreclosure and eviction moratorium several times over the last year and a half before letting the moratorium expire Sept. 30, 2020. All Florida Housing Coronavirus Relief Fund programs have ended in the state and extensions on unemployment lapsed the week of June 27.

shark girl // Shutterstock

Georgia

– Households that report falling behind on mortgage payment: 23.8% (#32 highest, 23.7% less than in 2020)

– Households with lost income that fell behind on mortgage: 34.4% (#20 highest, 13.1% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 27.4% (#16 highest, 33.9% less than in 2020)

A $354 million program launched in June 2021 in Georgia is expected to be a crucial source of rental and mortgage assistance and represents the state’s first installment of federal COVID-19 money to be used for mortgage assistance. This plan comes from American Rescue Plan Act funding, a plan of upwards of $9 billion that includes significant homeowner’s assistance for states. Georgia is among the states with the highest funding for mortgage relief behind just Florida, California, New York, and Illinois.

SvetlanaSF // Shutterstock

Hawaii

– Households that report falling behind on mortgage payment: 46.1% (#1 highest, 20.5% greater than in 2020)

– Households with lost income that fell behind on mortgage: 60.7% (#1 highest, 54.0% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 52.0% (#1 highest, 30.8% greater than in 2020)

Gov. David Ige on June 7 issued his 21st COVID-19 emergency proclamation to extend Hawaii’s ban on evictions for past due rent and mortgage payments by 60 additional days. The grace period will expire Aug. 6, just a week beyond the updated federal moratorium’s end of July 31. As of June 28, Hawaii ranked 14th in the country for vaccination rates, with 51.56% of the state’s population fully vaccinated. Gov. Ige has banned evictions for more than a year; when the two-month grace period ends, homeowners and renters will be responsible for making up for missed payments—or reaching a compromise with their banks or landlords.

Government bodies have been overwhelmed by applications for federal relief funds to assist with mortgage payments, with the City and County of Honolulu reopening its Rental and Utility Relief Program to another 10,000 applicants in early June; this was after preceding rounds of applications maxed out within four hours in one case and 20 minutes in another.

Charles Knowles // Shutterstock

Idaho

– Households that report falling behind on mortgage payment: 21.7% (#37 highest, 30.6% less than in 2020)

– Households with lost income that fell behind on mortgage: 27.2% (#29 highest, 26.2% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 22.2% (#28 highest, 7.1% less than in 2020)

The Idaho Housing and Finance Association in October 2021 announced the Idaho Heroes Loan Program, which offers a reduced mortgage rate of 2.375% to workers on the frontlines. Essential workers include nurses, doctors, firefighters, teachers, and retail workers, among others. Prospective buyers interested in participating must have lived in their home for at least one year. Idaho has among the lowest vacancy rates in the second quarter of 2021 (0.5%), second only to New Jersey with 0.7%.

marchello74 // Shutterstock

Illinois

– Households that report falling behind on mortgage payment: 39.9% (#2 highest, 56.4% greater than in 2020)

– Households with lost income that fell behind on mortgage: 35.9% (#16 highest, 21.2% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 50.1% (#2 highest, 134.5% greater than in 2020)

In May 2020, the Illinois General Assembly gave $300 million in aid to the Illinois Housing Development Authority to help residents pay the mortgage and rental payments during COVID-19. Sixty days later, the Illinois Housing Development Authority launched the Emergency Mortgage Assistance and the Emergency Rental Assistance programs. These initiatives covered payments that are past due and up until the period from March 1 to Dec. 30, 2020. Through these programs, homeowners received up to $25,000 and renters received up to $5,000. A total of $98.5 million was distributed to 10,071 households by the programs’ Dec. 30 deadline.

Maria V. Diaz // Shutterstock

Indiana

– Households that report falling behind on mortgage payment: 14.7% (#48 highest, 40.1% less than in 2020)

– Households with lost income that fell behind on mortgage: 21.7% (#44 highest, 27.9% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 16.6% (#44 highest, 5.6% less than in 2020)

During the COVID-19 pandemic, Indiana reopened its Hardest Hit Fund, which assists families at risk of losing their homes to foreclosure. That fund is not currently accepting applications, but Homeowner Assistance Fund, made possible through the American Rescue Plan Act, allocated $167.9 million to Indiana to help homeowners who were negatively impacted by COVID-19. That application period is expected to start by summer’s end. Indiana has the fourth-highest vacancy rate in the country at 2.2%.

JamesPatrick.pro // Shutterstock

Iowa

– Households that report falling behind on mortgage payment: 32.3% (#6 highest, 25.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 32.7% (#22 highest, 5.5% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.2% (#32 highest, 61.9% less than in 2020)

Several new rental and mortgage assistance programs became available for Iowa families in March 2021. Gov. Kim Reynolds has provided funding for the Iowa Homeowner Foreclosure Prevention Program, which offers a maximum of four months of mortgage payments to qualified households, or the equivalent of $3,600. To qualify, residents need to be making 80% less than the median income in their area and must be facing a significant risk of foreclosure due to the effects of COVID-19. Additionally, the Iowa Rent and Utility Assistance Program was also introduced, providing $195 million in rental assistance coming from the federal COVID-19 relief bill.

Jacob Boomsma // Shutterstock

Kansas

– Households that report falling behind on mortgage payment: 22.5% (#35 highest, 114.1% greater than in 2020)

– Households with lost income that fell behind on mortgage: 29.0% (#26 highest, 568.3% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 30.2% (#14 highest, 166.7% greater than in 2020)

Kansas has no statewide foreclosure protections in place. Kansas Housing Resources Corporation’s (KHRC) executive director Ryan Vincent told KWCH that the pandemic has turned Kansas’ housing issues from “a problem [to] a crisis in our state.” KHRC partnered with the Office of Rural Prosperity to kick off Kansas’ first comprehensive housing needs assessment in nearly three decades. Of particular interest is the state’s lack of affordable housing, specifically in rural and other underserved parts of the state. Kansas had the third-highest vacancy rates in the U.S. during the second quarter of 2021 at 2.4%.

Alexey Stiop // Shutterstock

Kentucky

– Households that report falling behind on mortgage payment: 32.7% (#5 highest, 30.5% greater than in 2020)

– Households with lost income that fell behind on mortgage: 23.2% (#40 highest, 19.0% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 14.2% (#47 highest, 43.0% less than in 2020)

The Kentucky Homeownership Protection Center offers resources for homeowners in need, but the state itself has no mortgage or foreclosure relief programs. Kentucky saw the third-largest increase in foreclosure starts among all states in April 2021, up 47% from April 2020, according to the April 2021 U.S. Foreclosure Market Report. That’s compared to a national decrease in foreclosure starts, down 26% nationally between April 2020 and 2021.

Sean Pavone // Shutterstock

Louisiana

– Households that report falling behind on mortgage payment: 29.0% (#13 highest, 29.5% greater than in 2020)

– Households with lost income that fell behind on mortgage: 45.3% (#6 highest, 75.7% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 32.5% (#9 highest, 62.6% greater than in 2020)

New Orleans Mayor LaToya Cantrell on June 23 announced the Homeowner Foreclosure Prevention and Mortgage Assistance Program, a new program for the city from Southeast Louisiana Legal Services (SLLS) to help prevent the foreclosure of homes in Orleans Parish. The program will assist eligible low-income homeowners and owner-occupied landlords of up to four units who are behind on mortgage payments and facing foreclosure. The funds for this program come from $3 million in funding from the Mayor’s Office of Housing Policy and Community Development.

Sean Pavone // Shutterstock

Maine

– Households that report falling behind on mortgage payment: 20.4% (#39 highest, 21.1% less than in 2020)

– Households with lost income that fell behind on mortgage: 29.8% (#23 highest, 14.8% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 23.0% (#25 highest, 15.8% less than in 2020)

In data collected May 12 to June 20, 2020, by the Center on Budget and Policy Priorities, a full 22% of adults in Maine (roughly 224,000 people) reported having trouble meeting their basic household expenses from mortgage payments to car payments. Using funds from the American Rescue Plan, Maine established several programs in the last year and a half to assist with helping Mainers make sure they can make their mortgage payments.

The state has allocated $50 million for a Homeowner Assistance Fund to assist with mortgage payments, pay utility bills, and decrease debt, $20 million directed toward anti-discrimination fair housing enforcement and $100 million for housing counselors. In addition, Maine has provided $152 for emergency rental assistance, and $25 million for emergency housing vouchers for those who are facing homelessness or are homeless, among other programs.

tokar // Shutterstock

Maryland

– Households that report falling behind on mortgage payment: 26.8% (#22 highest, 16.0% less than in 2020)

– Households with lost income that fell behind on mortgage: 36.7% (#15 highest, 15.1% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 24.6% (#21 highest, 33.2% less than in 2020)

Zombie foreclosures in Maryland jumped from 44 in the first quarter of 2021 to 151 in the second quarter, representing the largest jump in the country. Gov. Larry Hogan on June 15 announced an end to Maryland’s State of Emergency Order, with emergency mandates and restrictions ending by July 1. That date will also kick off a 45-day “grace period” during which certain assistance such as the moratorium on evictions and foreclosures, will remain in effect.

Sean Pavone // Shutterstock

Massachusetts

– Households that report falling behind on mortgage payment: 29.3% (#12 highest, 24.9% greater than in 2020)

– Households with lost income that fell behind on mortgage: 27.3% (#28 highest, 0.8% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 20.5% (#35 highest, 18.2% less than in 2020)

As of May 2021, upwards of 20% of Massachusetts residents have at least “moderate doubt” about how they will be able to pay their mortgages, which translates to more than 400,000 homeowners. However, via the Homeowner Assistance Fund, $180 million is set to be made available to Massachusetts homeowners by the early fall of 2021. That money will be mostly used to make sure that homeowners are up-to-date on their mortgages, but could also be used for utility bills and back taxes. This housing assistance stems from the $1.9 trillion Rescue Plan that President Biden signed in March 2021.

Sean Pavone // Shutterstock

Michigan

– Households that report falling behind on mortgage payment: 24.2% (#30 highest, 42.6% greater than in 2020)

– Households with lost income that fell behind on mortgage: 24.3% (#37 highest, 34.7% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.2% (#33 highest, 37.8% greater than in 2020)

Gov. Gretchen Whitmer, in concert with 225 financial institutions, extended Michigan’s mortgage assistance program through the rest of 2021 in an effort to ensure state residents struggling to make payments during the pandemic are able to keep their homes. Called the MiMortgage Relief Partnership, this program was founded in April 2020 and allows homeowners to reduce or postpone mortgage payments. Households can work with lenders, for example, to receive protection from foreclosure and 90-day forbearance from mortgage payments. The program can also help ensure homeowners’ credit scores are not adversely affected.

Jeffery Stone // Shutterstock

Minnesota

– Households that report falling behind on mortgage payment: 28.5% (#15 highest, 8.9% greater than in 2020)

– Households with lost income that fell behind on mortgage: 22.8% (#42 highest, 21.3% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 34.3% (#8 highest, 65.2% greater than in 2020)

Minnesota launched a $100 million program in 2020 from CARES Act funding to help homeowners and renters meet their payments. That program stopped accepting applications in December 2020. As of June 2021, Minnesota Housing is designing a program for the HomeHelpMN COVID-19 Homeowner Assistance Fund. However, RentHelpMN COVID-19 Emergency Rental Assistance is still taking applications as of June 2021. Meanwhile, a bill was passed in mid-June protecting renters who are applying for assistance to be evicted before June 2022.

Sean Pavone // Shutterstock

Mississippi

– Households that report falling behind on mortgage payment: 24.6% (#29 highest, 30.5% less than in 2020)

– Households with lost income that fell behind on mortgage: 39.2% (#11 highest, 17.6% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 23.2% (#24 highest, 27.5% less than in 2020)

As of June 2021, Mississippi doesn’t have financial assistance available for homeowners at the statewide level. However, homeowners and renters who are potentially at risk of eviction may be able to apply for the Rental Assistance for Mississippi Program following a court order. The state had protections for utility shutoff in place until May 2020. Of the roughly 120,000 households in Minnesota with FHA-backed mortgages, 13,000 of those mortgages were delinquent as of December 2020.

Colton lee garcia // Shutterstock

Missouri

– Households that report falling behind on mortgage payment: 19.0% (#43 highest, 40.7% less than in 2020)

– Households with lost income that fell behind on mortgage: 25.6% (#32 highest, 23.2% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 24.6% (#22 highest, 0.4% less than in 2020)

Missouri stopped providing COVID-19 federal unemployment benefits in June 2021. State Assistance for Housing Relief (SAFHR) has been providing assistance for renters and tenants; and the state is working on launching SAFHR for Homeowners this summer, which is expected to provide assistance for housing relief in the form of mortgage help, among other services. While awaiting that funding, the Missouri Housing Development Commission is seeking a stop-gap by soliciting help from legal service and housing counseling agencies to help protect homeowners from foreclosures and displacement.

Jacob Boomsma // Shutterstock

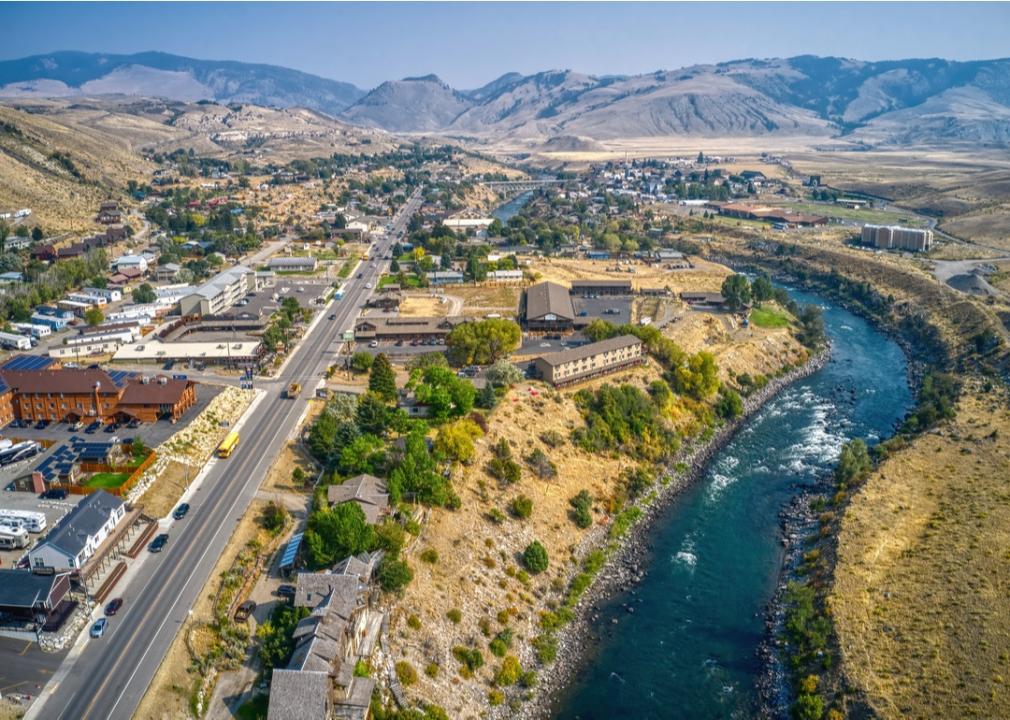

Montana

– Households that report falling behind on mortgage payment: 33.2% (#4 highest, 93.3% greater than in 2020)

– Households with lost income that fell behind on mortgage: 14.7% (#47 highest, 28.9% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 49.1% (#3 highest, 536.9% greater than in 2020)

Montana established a mortgage and rental assistance program that began in April 2020. That initiative has ended, but in 2020 it successfully distributed $8.4 million to mortgage servicers and landlords. The state’s Emergency Rental Assistance Program, launched April 2021, is not available to homeowners. The state opted out of federal boosts to unemployment payments, but in May launched a $1,200 one-time payment for residents beginning new jobs to incentivize those who have been out of work. The state’s unemployment rate fell to 3.8% by May, bringing it within striking distance of pre-pandemic levels.

Ken Schulze // Shutterstock

Nebraska

– Households that report falling behind on mortgage payment: 14.3% (#50 highest, 54.6% less than in 2020)

– Households with lost income that fell behind on mortgage: 29.5% (#24 highest, 5.3% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 16.9% (#42 highest, 35.4% less than in 2020)

The Nebraska Housing Developers Association on April 21, 2021, launched an initiative to help homeowners make payments designated for air conditioning and heating. Called the All Seasons Affordability Program, this initiative will replace older, malfunctioning HVAC devices, or provide them if not available, in order to help make monthly utility bills more affordable. A total of $9,000 could be provided to households who qualify. To be eligible, homeowners have to be above the age of 55, live in a home with three or more bedrooms, or have a disability or disabilities. Lowering utility bills—especially in the winter—could have a big impact on lower-income residents.

Real Window Creative // Shutterstock

Nevada

– Households that report falling behind on mortgage payment: 25.8% (#24 highest, 2.1% greater than in 2020)

– Households with lost income that fell behind on mortgage: 24.4% (#35 highest, 5.7% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 23.9% (#23 highest, 2.0% less than in 2020)

Nevada’s Hardest Hit Fund, which has provided crucial mortgage assistance to homeowners who lost income due to COVID-19, is paused as of at least June 2021. The initiative provided up to $3,000 per month for three months in assistance. The fund was eligible to residents who were receiving state unemployment insurance and who lost their jobs as a result of COVID-19.

Additional assistance for homeowners with mortgages is expected to come to Nevada in the form of $121 million in Homeowner Assistance Funds, part of the American Rescue Plan. The math works out to roughly $14,500 per household in assistance—but the process of distribution and administrative work could prevent homeowners from getting the emergency aid until late August.

Wangkun Jia // Shutterstock

New Hampshire

– Households that report falling behind on mortgage payment: 20.2% (#40 highest, 22.5% less than in 2020)

– Households with lost income that fell behind on mortgage: 11.1% (#50 highest, 47.9% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 25.6% (#19 highest, 2.7% greater than in 2020)

New Hampshire stopped providing mortgage assistance after the New Hampshire Relief Program came to an end in December 2020. The state does continue to provide rental assistance for households that are facing significant income losses due to COVID-19. Launched in March 2021, the New Hampshire Emergency Rental Assistance Program covers rent, utilities, and any relocation fees related to COVID-19. Households can receive up to $2,500 in funding. The state has the fourth-lowest vacancy rate in the country, with 0.4%.

Andrew F. Kazmierski // Shutterstock

New Jersey

– Households that report falling behind on mortgage payment: 25.5% (#26 highest, 14.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 24.4% (#36 highest, 17.7% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 30.9% (#13 highest, 15.1% greater than in 2020)

New Jersey Gov. Phil Murphy signed an executive order in March 2020 establishing an eviction moratorium for renters and homeowners through January 2022. Lawmakers throughout the state are working to ensure New Jersey doesn’t rank #1 as it did following the Great Recession in foreclosures. Efforts include a law forcing lenders to delay or lower mortgage payments if borrowers’ income was negatively impacted by the pandemic, adding any defaulted payments to the end of the mortgage, and finalizing the logistics of the Homeowner Assistance Fund that was allocated $325 million in March from the federal government.

Faina Gurevich // Shutterstock

New Mexico

– Households that report falling behind on mortgage payment: 24.9% (#28 highest, 7.0% greater than in 2020)

– Households with lost income that fell behind on mortgage: 38.1% (#13 highest, 58.2% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 31.4% (#11 highest, 26.5% greater than in 2020)

New Mexico Homeowner Assistance Fund provides emergency funds for residents facing potential housing instability. Residents who have faced financial hardship due to COVID-19 can receive up to $10,000 in funding and are able to apply again after receiving the initial funds. Homeowners can apply until Nov. 5, 2021, and the funds will be paid directly to the loan servicer.

Michal Grzechulski // Shutterstock

New York

– Households that report falling behind on mortgage payment: 27.4% (#21 highest, 21.7% less than in 2020)

– Households with lost income that fell behind on mortgage: 22.9% (#41 highest, 37.5% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 15.3% (#45 highest, 58.6% less than in 2020)

Assistance to struggling New York homeowners is on its way, but residents will have to wait until the federal foreclosure moratorium lapses at the end of July; they have already been waiting for the aid for more than a year. The state will utilize in excess of $540 million in federal relief funds for homeowners facing foreclosure. The application process for this help is anticipated to commence in September. Competition is likely to be stiff: New York is home to almost 4 million owner-occupied homes. In New York City alone, around 75,000 homeowners face the possibility of foreclosure in the next year.

Joseph Sohm // Shutterstock

North Carolina

– Households that report falling behind on mortgage payment: 12.3% (#51 highest, 49.0% less than in 2020)

– Households with lost income that fell behind on mortgage: 25.5% (#33 highest, 4.9% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 12.1% (#48 highest, 52.1% less than in 2020)

North Carolina’s State Home Foreclosure Prevention Project offers free counseling to homeowners along with referrals for free legal help to qualified residents. North Carolina is on tap to receive $273 million in funding to help homeowners make mortgage payments; but as with other states, residents are forced to wait while the details are ironed out and applications are made available. The funding represents North Carolina’s first statewide assistance program for households with mortgages. A similar bill was introduced in the House in 2020 but did not pass.

Jacob Boomsma // Shutterstock

North Dakota

– Households that report falling behind on mortgage payment: 23.9% (#31 highest, 44.9% greater than in 2020)

– Households with lost income that fell behind on mortgage: 26.7% (#30 highest, 101.0% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 37.6% (#6 highest, 159.8% greater than in 2020)

This fall, North Dakota’s Department of Human Services will partner with the North Dakota Housing Finance Agency to offer a program offering mortgage assistance for eligible households, among myriad other services. Other aid for homeowners in six North Dakota cities comes in the form of a home improvement loan program, providing low-interest loans ranging from $10,000 to $75,000 for the purposes of revitalizing neighborhoods. That application period runs until Oct. 31.

dvgpro // Shutterstock

Ohio

– Households that report falling behind on mortgage payment: 18.9% (#44 highest, 9.9% less than in 2020)

– Households with lost income that fell behind on mortgage: 11.9% (#49 highest, 44.1% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 14.8% (#46 highest, 26.1% less than in 2020)

The Ohio Home Relief Grant program provides financial assistance for eligible homeowners on their mortgage payments. Applicants must have had their incomes negatively impacted by the pandemic. Foreclosure starts climbed 96% in the state from April to May, the highest jump in the country, according to research from RealtyTrac, a division of ATTOM Data Solutions. Almost every Ohio city had higher rates of bank foreclosure notices this spring.

RaksyBH // Shutterstock

Oklahoma

– Households that report falling behind on mortgage payment: 34.5% (#3 highest, 49.8% greater than in 2020)

– Households with lost income that fell behind on mortgage: 17.7% (#45 highest, 27.5% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 41.1% (#4 highest, 86.6% greater than in 2020)

Oklahoma is in the process of launching a financial assistance fund for homeowners; in the meantime, people struggling to meet their mortgage payments can access resources through the Oklahoma Department of Commerce. The Oklahoma Homeowner Assistance Fund Program was allocated about $87 million from the Homeowner Assistance Fund (HAF), established by the American Rescue Plan Act of 2021. Oklahoma had the 12th-highest mortgage delinquency rate as of January 2021.

Josemaria Toscano // Shutterstock

Oregon

– Households that report falling behind on mortgage payment: 20.1% (#41 highest, 20.5% less than in 2020)

– Households with lost income that fell behind on mortgage: 38.7% (#12 highest, 34.1% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 22.8% (#26 highest, 30.5% greater than in 2020)

Oregon’s Housing and Community Services and Department of Justice offer various support for struggling homeowners unable to make mortgage payments. Multiple banks have filed suits against the state for extending foreclosure moratoriums. Oregon lawmakers in June voted to reinstate the foreclosure moratorium that had expired in December 2020; it now runs through Dec. 31.

Jon Bilous // Shutterstock

Pennsylvania

– Households that report falling behind on mortgage payment: 28.0% (#17 highest, 21.9% less than in 2020)

– Households with lost income that fell behind on mortgage: 40.1% (#10 highest, 5.5% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 27.4% (#17 highest, 33.8% less than in 2020)

In its 2021 budget, Pittsburgh allocated $10 million of federal coronavirus relief aid for the creation of a new program at the Urban Redevelopment Authority that will offer various home-improvement funds to eligible homeowners. The state missed the Nov. 30 deadline to pay out $108 million of $175 million in rent and mortgage aid; that money was slated for redistribution to the Pennsylvania Department of Corrections.

Albert Pego // Shutterstock

Rhode Island

– Households that report falling behind on mortgage payment: 26.3% (#23 highest, 11.7% greater than in 2020)

– Households with lost income that fell behind on mortgage: 34.3% (#21 highest, 65.9% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 31.0% (#12 highest, 47.7% greater than in 2020)

Rhode Island Housing offers numerous resources for homeowners seeking forbearance on their mortgage payments, whether they have a government-insured mortgage (FHA, VA, or USDA), an FNMA loan, or for those who are RIHousing mortgage customers. The Rhode Island House on June 17 approved a $13 billion spending plan that would include $129 million for rent and homeowner assistance.

PQK // Shutterstock

South Carolina

– Households that report falling behind on mortgage payment: 25.5% (#25 highest, 38.0% less than in 2020)

– Households with lost income that fell behind on mortgage: 23.6% (#39 highest, 50.1% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.0% (#34 highest, 49.5% less than in 2020)

South Carolina legislation passed in May 2020 calls for all foreclosure actions to certify compliance with the CARES Act. The state’s residents were rated among the top-10 most fearful of foreclosure risks in 2021. South Carolina also ranked among the state with the biggest increase in zombie foreclosures between Q1 and Q2 of 2021, rising from 79 to 133. As part of the CARES Act, SC Stay commenced a $25 million program in February 2021 to provide eligible renters and homeowners up to $7,500 for six months to cover back or future payments.

Sopotnicki // Shutterstock

South Dakota

– Households that report falling behind on mortgage payment: 14.6% (#49 highest, 21.4% less than in 2020)

– Households with lost income that fell behind on mortgage: 29.4% (#25 highest, 54.2% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 10.7% (#49 highest, 58.5% less than in 2020)

The South Dakota Housing Development Authority (SDHDA) in October 2020 was awarded $10 million to distribute to at-need South Dakotans for past or future rent, mortgage, or utility payments. The term of the assistance ran from March 1 to Dec. 30, 2020. Payments, which could go up to $1,500 a month, were directly submitted to landlords, mortgage holders, or utilities. The application process continued until funds ran out, or Dec. 18, 2020. Meanwhile, average home prices in South Dakota jumped 19.3% between April 2020 and 2021.

Anne Kitzman // Shutterstock

Tennessee

– Households that report falling behind on mortgage payment: 24.9% (#27 highest, 24.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 41.7% (#8 highest, 18.4% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 20.3% (#37 highest, 46.8% less than in 2020)

More than 1 in 5 adult Tennesseans with children during the pandemic reported having low to zero confidence in their ability to pay their latest mortgage or rent bill. That number dropped to 13% in March of 2021, signaling the start of a comeback, although confidence is lower in Black communities than white. Overall, Tennessee’s first-quarter 2021 trends, covered in June by the MTSU Business and Economic Research Center’s statewide report, indicate positive gains in mortgage tax collections, homeowner vacancy rates, home prices, and real estate transfer tax collections and foreclosure rates.

Roschetzky Photography // Shutterstock

Texas

– Households that report falling behind on mortgage payment: 27.7% (#19 highest, 44.2% less than in 2020)

– Households with lost income that fell behind on mortgage: 26.1% (#31 highest, 39.4% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 20.5% (#36 highest, 51.0% less than in 2020)

As of June 2021, Texas does not offer specific programs for mortgage relief. It does, however, provide guidance to homeowners affected financially by the pandemic. Texas does provide rental assistance via the Texas Rent Relief Program. In this program, tenants can receive funding as far back as March 13, 2020, for rent that’s expected, current, or past due. Additionally, after receiving three months’ worth of assistance, tenants may be able to apply again for three more months worth of rental assistance.

Jason Finn // Shutterstock

Utah

– Households that report falling behind on mortgage payment: 22.8% (#34 highest, 22.4% greater than in 2020)

– Households with lost income that fell behind on mortgage: 27.8% (#27 highest, 43.7% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.3% (#31 highest, 63.3% greater than in 2020)

Eligible Utah residents living in Salt Lake City, Taylorsville, Sandy, and South Jordan have various mortgage assistance programs available to them. The CDC Utah provides emergency pandemic-related funding for households in need of mortgage aid due to job loss or other financial challenges. In Salt Lake City, for example, residents who earn less than 60% of the median income could be eligible to receive a grant of up to $5,000 per month for three months. Those who make above 60% of the median could be eligible for a 2% interest housing loan.

Jay Yuan // Shutterstock

Vermont

– Households that report falling behind on mortgage payment: 20.6% (#38 highest, 28.7% less than in 2020)

– Households with lost income that fell behind on mortgage: 17.5% (#46 highest, 39.3% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 9.0% (#50 highest, 61.3% less than in 2020)

Vermont set up a mortgage assistance program that began accepting applications in May 2021. Called the Vermont COVID Emergency Mortgage Assistance Program, this initiative from the Vermont Housing Finance Agency will help households that have mortgages entered before March 1, 2020. To be eligible, Vermont residents must have had an income of $84,000 or less in 2020. If approved, the fund will pay up to 12 months of mortgage payments or 12 months of property taxes that are past due.

Felix Mizioznikov // Shutterstock

Virginia

– Households that report falling behind on mortgage payment: 31.8% (#7 highest, 43.7% greater than in 2020)

– Households with lost income that fell behind on mortgage: 47.2% (#5 highest, 107.4% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 27.6% (#15 highest, 8.9% greater than in 2020)

In March 2021, Gov. Ralph Northam announced a plan for eviction prevention and to address the systemic, underlying causes of evictions. Called the Virginia Eviction Pilot Program, the plan will provide $2.6 million in grants to 14 areas that have the highest eviction rates in Virginia. These include James City, Williamsburg, Norton, Gloucester, and Lee, among others.

Artazum // Shutterstock

Washington

– Households that report falling behind on mortgage payment: 29.8% (#10 highest, 43.8% greater than in 2020)

– Households with lost income that fell behind on mortgage: 42.4% (#7 highest, 132.1% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 17.5% (#40 highest, 15.8% less than in 2020)

As of June 2021, the Walla Walla area is providing homeowners in need of financial assistance due to COVID-19. Through the Blue Mountain Action Council and federal CARES Act funding, residents whose incomes have been affected by the pandemic in the area can apply to receive three months’ worth of mortgage assistance. Walla Walla also provides funding for renters. The state’s Treasury Rent Assistance Program can help eligible homeowners with up to a year of rent or utility coverage. Households making less than 80% of the median income in Walla Walla qualify.

Investor-owned electric and natural gas utilities are required by the Washington Utilities and Transportation Commission to follow a moratorium on disconnections for non-payment up to July 31, 2021. The relief allows struggling renters and homeowners to focus on paying off other immediate expenses in the interim while not falling so far behind.

Tupungato // Shutterstock

Washington D.C.

– Households that report falling behind on mortgage payment: 19.6% (#42 highest, 20.7% less than in 2020)

– Households with lost income that fell behind on mortgage: 6.5% (#51 highest, 82.6% less than in 2020)

– Unemployed respondents who fell behind on mortgage: 32.0% (#10 highest, 24.2% less than in 2020)

District of Columbia Housing Finance Agency offers help for homeowners struggling to make payments with DC MAP, or Mortgage Assistance Program. Eligible households can get as much as $5,000 monthly in financial assistance toward a mortgage for up to half a year. The funding comes in the form of a zero-interest, recourse loan. The median income required for homeowners to live within their means in our nation’s capital is $142,230 annually ($122,934 for renters), putting enormous pressure on households during the pandemic.

Real Window Creative // Shutterstock

West Virginia

– Households that report falling behind on mortgage payment: 28.3% (#16 highest, 22.3% less than in 2020)

– Households with lost income that fell behind on mortgage: 47.3% (#4 highest, 1.9% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 21.5% (#29 highest, 26.7% less than in 2020)

The West Virginia Housing Development Fund is offering a mortgage assistance application for households whose incomes have been jeopardized by COVID-19. To apply, West Virginians need to provide income verification, an expense form, among other items to be considered. Additionally, the state also has the Mountaineer Rental Assistance Program for those who are behind on rent. The funding can cover past due rent as of April 1, 2020, in addition, to rent up to three months in the future, as of June 2021.

James Meyer // Shutterstock

Wisconsin

– Households that report falling behind on mortgage payment: 16.0% (#47 highest, 23.5% less than in 2020)

– Households with lost income that fell behind on mortgage: 36.8% (#14 highest, 80.7% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 16.8% (#43 highest, 25.7% less than in 2020)

The Milwaukee County Mortgage Assistance Program offers financial assistance to prevent home foreclosure. Applications were accepted until June 18, 2021. For applications who are accepted, the program can provide up to six months of mortgage assistance. The amount of assistance a household receives depends on its size. A household of one person, for example, can receive up to $47,250 in total funds, and a house of four can receive up to $67,500.

GagliardiPhotography // Shutterstock

Wyoming

– Households that report falling behind on mortgage payment: 22.0% (#36 highest, 7.0% less than in 2020)

– Households with lost income that fell behind on mortgage: 50.9% (#3 highest, 87.8% greater than in 2020)

– Unemployed respondents who fell behind on mortgage: 6.2% (#51 highest, 80.7% less than in 2020)

Mortgage assistance is on its way in Wyoming, but at press time the state is still waiting along with others for the funding, which is part of the American Rescue Plan Act’s Homeowner Assistance Fund. For renters in need of financial assistance, the state launched the Emergency Rental Assistance Program in June 2021. In total, the program is expected to provide $180 million in crucial rental assistance. Wyoming anticipates that around 23,000 households will qualify for the new rental relief program.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.