How the Housing Shortage Impacts Buyers and Sellers

A recent report from Redfin shows that housing inventory in the U.S. is at its lowest point in seven years. What’s causing this shortage? Shifts in the housing market are never easy to explain, but a major contributing factor is the downturn of new builds.

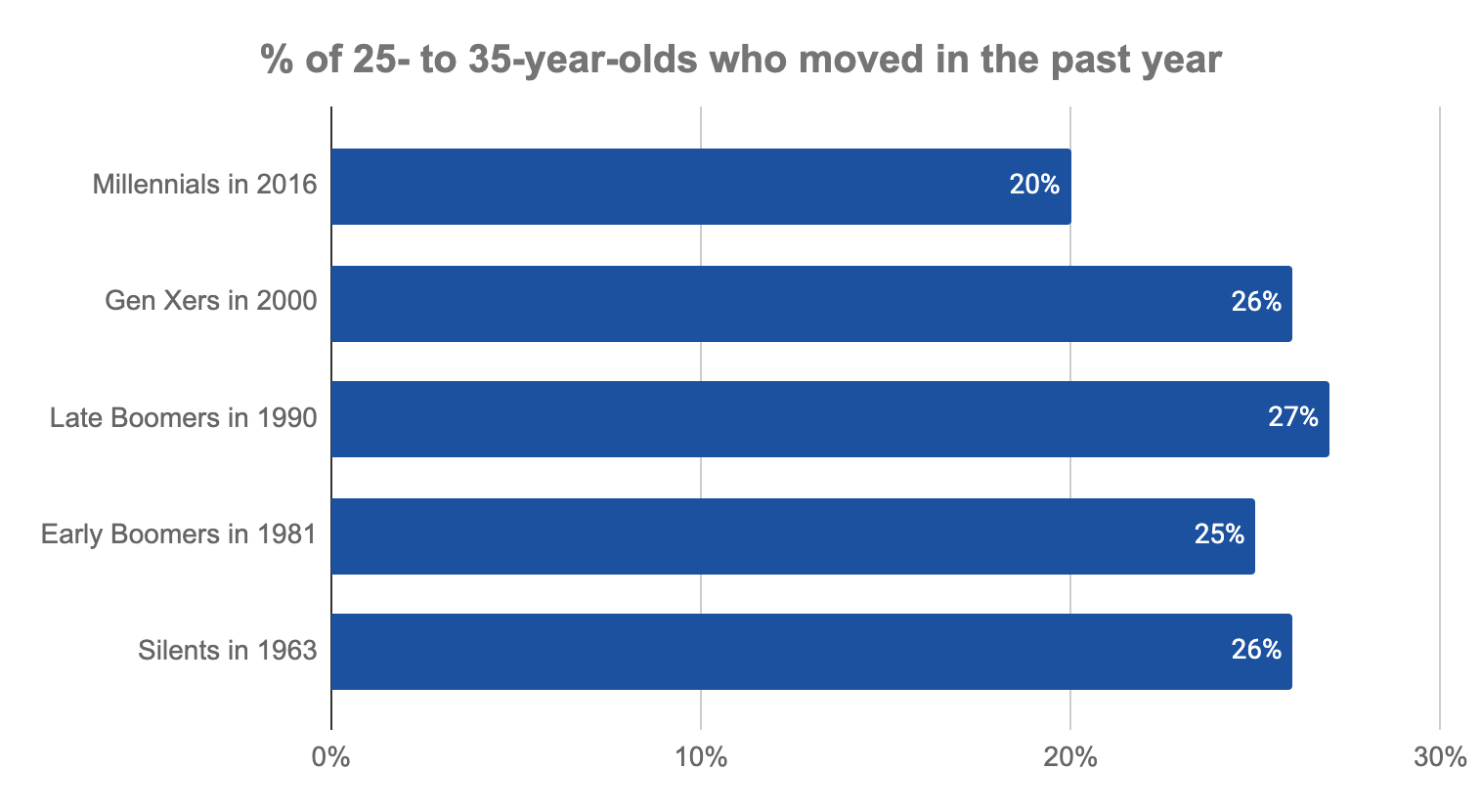

After the housing crisis in 2008, government regulations on construction created disincentives for builders to build new homes. Additionally, millennials simply aren’t moving and buying homes as frequently as previous generations. Taken together, these trends have slowed the rate of new home construction and exacerbated the housing shortage.

The shortage is no big deal if you own a home and have no intentions of moving. But housing shortages drive up average home prices and have a profound financial impact on homebuyers and owners looking to sell.

Millennials are less likely to move than prior generations

Source: Pew Research Center

What low housing inventory and high prices mean for the housing market

With fewer new homes being built, housing inventory overall remains low. In this environment, older homes saturate the market. Older homes can be fantastic investments, but they also require upgrades and renovations.

Fewer homes for sale also create a more competitive housing market, where homes on the market are likely to receive multiple offers. The result is that buyers must pay a premium to secure a home. Knowing they are paying top dollar, most buyers want homes that are turnkey. After all, they can finance the whole amount of a renovated house in a 30-year mortgage.

The last thing buyers want is to pay a premium for an older house that needs to be remodeled. Banks are restrictive in lending to new homeowners who want to finance renovation projects. In a market where buyers are already paying a heavy price, most don’t have the additional liquid cash to invest in making an older home habitable and safe.

Here is a simplified way to look at how the process plays out:

- Lack of new construction means low housing inventory dominated by older homes

- Low inventory means more buyers competing for fewer homes, driving up prices

- Higher prices mean buyers demand more move-in ready homes

- Demand for move-in ready homes means sellers take on costly renovation projects

- Complicated renovations mean less money in the seller’s pocket

The bottom line for the seller

Low housing inventory may lead to higher sales prices, but they come at a high cost to sellers. Owners of older homes thinking about selling bear the brunt of this cost, as they cannot expect their house to attract buyers if it hasn’t been updated first.

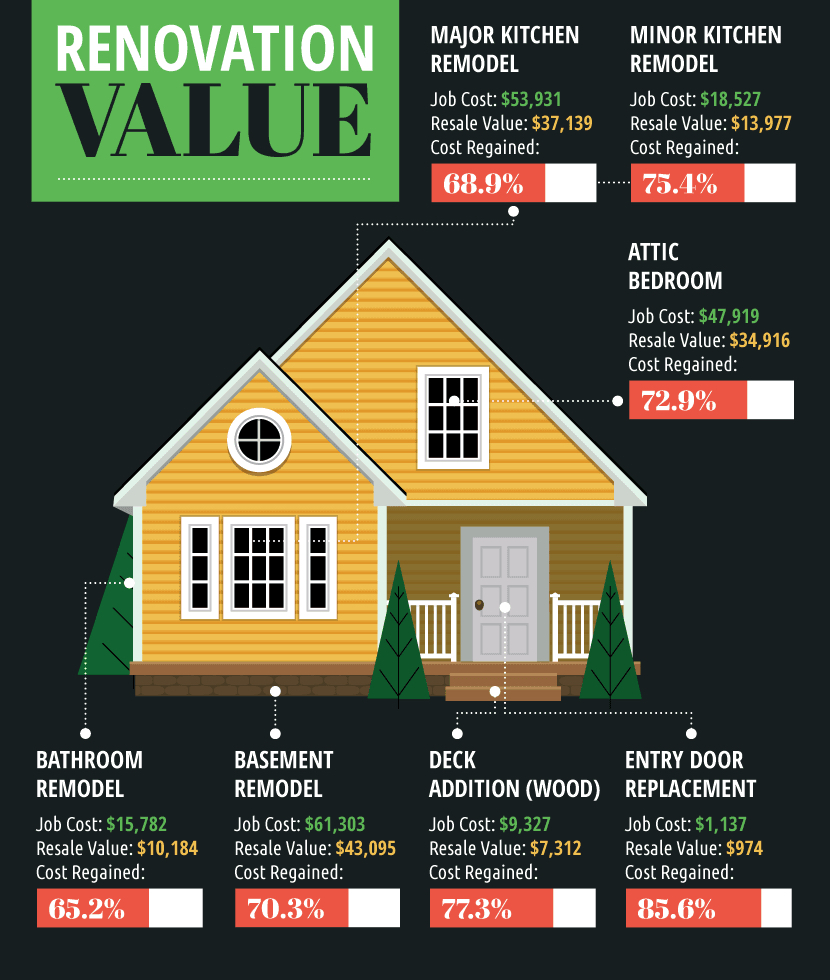

HomeAdvisor reports that the average costs for a home renovation are between $25,000-$75,000. However, that figure is the nationwide average among all homes. Older homes will likely require significant changes to wiring, plumbing, and other key features, meaning an expensive, time-consuming remodel.

From a pure ROI perspective, this expenditure is not likely to lead to a strong dollar for dollar return for the seller. In fact, even the most valuable renovations aren’t likely to recoup 100% of the upfront cost.

Off-market buyers help to reverse the trend

While the average buyer doesn’t have cash on hand to contribute to both a down payment and a large renovation project, many real estate flippers do. Not only do these off-market buyers have the cash resources, they also possess the expertise to execute a home renovation that is profitable. As a homeowner, you’re likely to spend far more on renovations than a professional flipper with industry knowledge and professional connections. Unless you have expertise in home construction and design, you’ll end up with a lower quality remodel, too.

Flippers don’t increase housing inventory per se, but they help ensure that inventory is move-in ready, letting new homeowners avoid having to come up with the money for an expensive renovation.

Consider the following scenarios:

Scenario 1:

A buyer purchases a fixer upper for $200,000, putting 20% down to finance a $160,000 mortgage. The buyer then must spend $50,000 on renovations to make the house safe and livable. The net result is the buyer must come up with $90,000 out of pocket (20% down payment + $50,000 renovation) for a $250,000 house.

Scenario 2:

A flipper buys the same home for $200,000, updates it and puts it back on the market for $300,000. The buyer puts 20% down and finances $240,000 on a 30-year-mortgage. The net result is the buyer came out of pocket $60,000 out of pocket (20% down payment) for a $300,000 move-in ready house.

Beyond the cash and quality elements, many homeowners simply don’t want to deal with the uncertainty and risk. Horror story after horror story characterizes the business of DIY home flipping, which deters many buyers from even considering it.

Why sell with Sundae

Sundae can help owners get more cash for their home off-market. Because Sundae maintains rigorous criteria in the homes that we accept and list on our marketplace and the investors we work with, we turn un-financeable nightmares into move-in ready homes. The result is the equivalent of a “certified preowned home” going back on the market.

Sundae isn’t the only way that buyer’s and seller’s can overcome challenges presented by the national housing shortage. However, it is a potentially profitable option for many.

Sundae offers homeowners a higher price than other cash buyers because we keep less profit for ourselves. Many homes sit on the market for an indeterminate amount of time due to needed renovations and a disinterest among buyers in completing those renovations. Sundae has the resources to help sellers receive a cash offer and complete the deal in a short amount of time. Sundae also offer eligible homeowners a cash advance before the deal is completed to help with expenses.

—

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.