Considering Retirement? 3 Things an Economist Wants You to Know

Everyone working aims to retire some day. For Baby Boomers, this time is quickly approaching. Understanding certain trends heading into 2022 will help inform your decisions leading up to and during retirement.

After working for the majority of your life, retirement is finally within your grasp. Many Baby Boomers like you are already at or approaching this life milestone. There are a variety of big decisions looming ahead. During the planning process, questions abound: should you retire and start the next chapter of life? What does retirement actually look like?

As you begin to contemplate retirement, it’s important to consider a variety of options. In this article, we examine trends that can help inform your big decision.

Be mindful of health and finances

The onset of COVID caused people to leave the workforce. Though it appears that more people entered retirement during the pandemic, it’s actually more accurate to say that fewer people have re-entered the workforce. There’s a big distinction between these.

Forced retirement

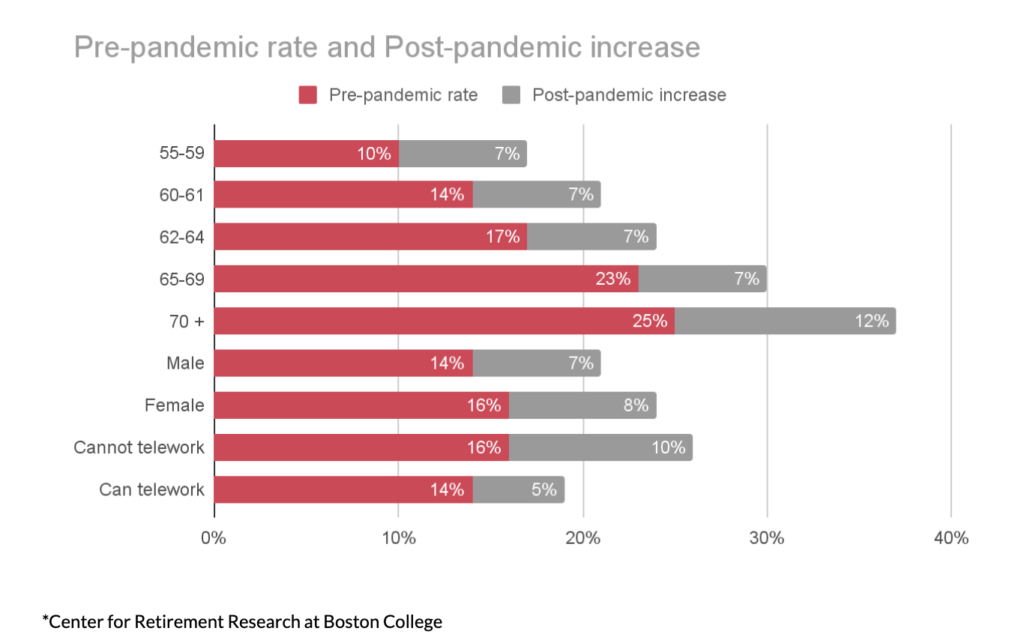

As long as COVID persists, high human-contact jobs are going to carry higher risk. Many of the jobs lost during the pandemic were in high human-contact sectors. According to the Center for Retirement Research at Boston College, COVID particularly increased job exits for those with no college degree, women and those unable to work remotely.

Forced retirement during a pandemic is probably not what you’d had in mind. The picture perfect retirement those who were looking forward to it probably had something much different in mind. The appeal of early retirement is having more time to visit friends and family or take vacations. It’s harder to do so when traveling is risky and new COVID variants keep popping up.

Financial and physical health

There are several other things to consider as well. Once benefits or savings run out and retirees have to turn to retirement accounts, early 401K or IRA withdrawals can trigger penalties. Social security checks before a full retirement age of 67 are also much smaller.

Before the pandemic, the advice would be to think long and hard whether it makes financial sense to retire, but when someone’s health is involved, the math is different.

Research shows that the rate at which older workers left employment increased dramatically during the COVID pandemic. However, between April 2019 and June 2021 the rate of social security claims among all workers 55 and older remained constant. This indicates that some older workers may intend to return to their jobs once the pandemic ends.

This is good news for those who are considering part-time jobs down the line. They will warrant higher Social Security benefits in the future and during a high inflation period, wages usually go up, which means quality of life can be preserved.

Consider home ownership in retirement

Home ownership is not for everyone. When it comes to owning versus renting in retirement, it’s an individual lifestyle decision. Each side has its pros and cons.

If you rent, you don’t have to worry about upkeep and other changes such as home maintenance, unpredictable repairs, property tax hikes. In addition, as long as a long-term lease is in place, monthly expenses are predictable when renting.

On the other hand, owning can also give more stability and financial freedom. For example, you can rent out a room in your house. It also offers the opportunity to lock in a fixed interest rate. In today’s world of rising real estate prices and rents, monthly payments can earn retirees equity and ability to borrow against it. Contrastingly, rent is only an expense for a place to live.

Purely from a financial standpoint, it might make sense to downsize and buy a retirement property for cash or lock in fixed payments. This isn’t, however, for people who would place more value on freedom and no upkeep responsibility than on stability that comes with owning a home.

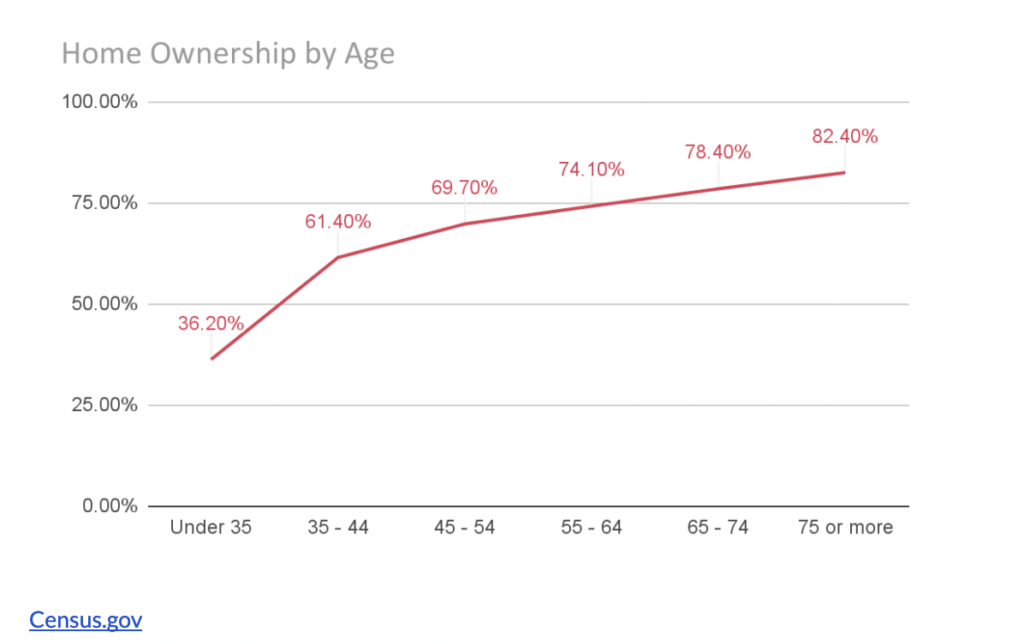

With rising inflation and supply chain shortages, more people opt to own in retirement. Homeownership by age shows that 82% of people 75 and above own.

Factors to be aware of when moving or downsizing in retirement

Normally, the increased number of retirements would translate into a spike in the number of people who moved for retirement. This didn’t happen in 2021. Actually, just the opposite happened. The number of retirees who moved for retirement fell roughly 43% compared to previous years.

There are several things at play. In order to move and buy a retirement property, you need to identify the ideal house. Given the nature of the real estate market, it’s hard to buy what’s not for sale. The pain of low inventory is felt across all segments, but retirees in particular. Those considering retirement have more decision making to do than other demographics.

Taxes, weather, and family

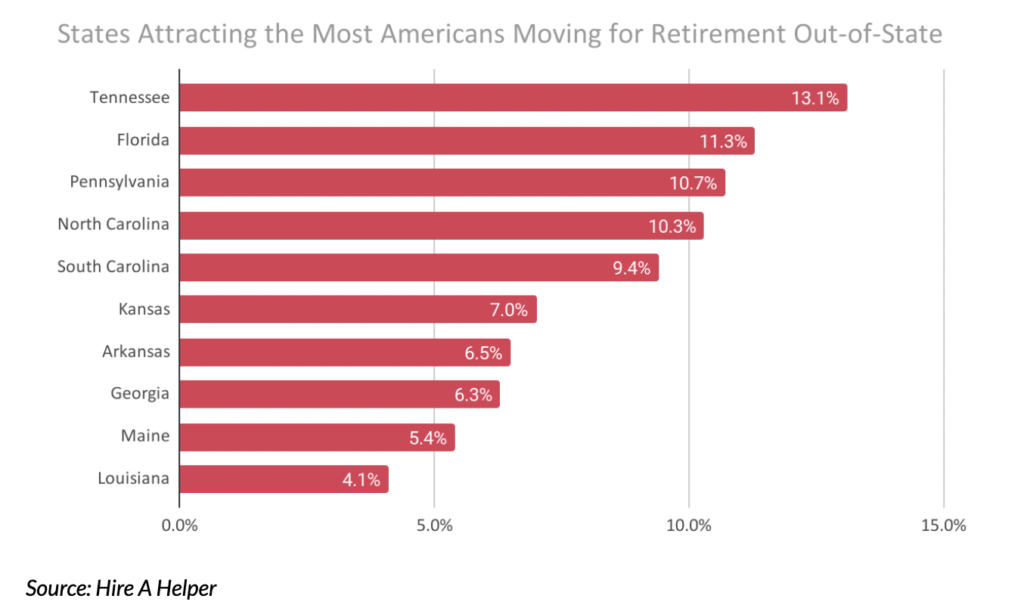

In 2021, one in five, or 20% of Americans under the age of 65, who left their state to move for retirement, moved to Tennessee. Tennessee has the lowest tax burden after Alaska. It also attracts more and more younger people whose parents have chosen to move closer to them.

Moving for retirement simply meant a warmer destination and better tax environment, but that’s no longer the case. More and more Baby Boomers choose multi-generational homes. They’re moving closer to their grown kids in retirement to spend more time with their grandchildren. Retirees who make this move are also helping their families both emotionally and financially.

With those factors as considerations, it shows that weather and taxes aren’t the only things retirees are weighing. Retirees are following their kids to areas that offer economic growth and stability with a lower cost of living. Places like Florida and other top destinations meet this mold. Moving forward, it appears that Charlotte, Austin, Phoenix, Nashville, and Dallas are the favorite destinations for retirees who are moving closer to kids.

Retiring in 2022

While retiring symbolizes the end of working, it’s also the beginning of something new and exciting. By looking deeper into topics that will have an impact on your retirement, you will be equipped to make the best decisions for you and your family.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.