The Myth of Forthcoming Foreclosures

There’s murmur in the real estate industry that an influx of foreclosure inventory is coming, but we disagree. Here’s why.

The last extension to COVID-19 housing relief options like foreclosure moratorium and forbearance plan terms were set to expire in March of 2021. But on Feb. 16, the Biden Administration issued a statement that:

- Extended the foreclosure moratorium through June 30, 2021

- Extended the mortgage forbearance so borrowers may enroll until June 30, 2021

- Provided up to two three-month extensions to borrowers who entered into a forbearance before June 30, 2020

These relief programs have provided essential support to struggling Americans throughout the pandemic. But what’s going to happen to the forbearance plans once they reach their expiration date this summer? It’s a widely contemplated topic. Some predict that the inventory of foreclosed homes will increase as much as 1.1 million by the end of the third quarter of 2021, but we disagree. Instead, we think most of these homes will sell before going to auction.

Looking at the numbers

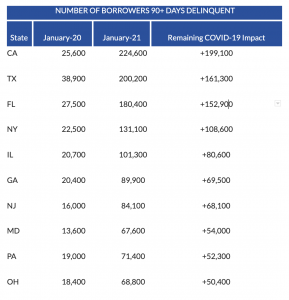

Roughly 6.7 million Americans have been in mortgage forbearance at some point since the onset of the pandemic. The number of early-stage delinquencies is at pre-pandemic levels, and the number of borrowers with a single missed payment decreased by 24%. However, in contrast, serious delinquencies of 90 days or more remain five times their pre-pandemic levels. The moratorium kept foreclosure actions away over the past year, but at the end of 2020, roughly 2.1 million mortgages were seriously delinquent.

Reason 1: Old modeling techniques

One of the reasons for the fears and pessimism is that many industry veterans are using their old modeling techniques, like forecasting 2 to 4 months for foreclosure to take place after notice of default is issued, to forecast distressed supply, which doesn’t hold true under current market conditions for several reasons:

- Unprecedented market appreciation

- Not all delinquencies are created equal; timing and place matter

- Not all people who went delinquent will be experiencing hardship once programs expire

Reason 2: Homeowner equity will translate into distressed assets to be sold before the foreclosure auction

While the speed of recovery and the rate of improvement could accelerate or decelerate based on variable economic factors, another reason for a pessimistic outlook is the lack of incentives for borrowers to leave the forbearance plans early.

With no near-term consequences of not paying, getting accustomed to not making payments is easy, but there’s going to be some shock when borrowers have to pay again. This in turn puts a lot of pressure on the servicing entities because the forborne interest, as well as tax and insurance payments, could have a negative impact on borrowers’ equity. Given the current rate of home price appreciation in the housing market, and the equity gains from last year, the negative impacts of deferred payments are likely to be offset. At the end of Q2 2020, BlackKnight estimated that just one in 10 homeowners in forbearance have less than 10% equity in their home due to home price growth. Ten percent equity is typically the minimum needed to go through the traditional real estate selling channels and avoid foreclosing on the property. The market is continuing to go strong with January posting a record 10.4% year over year price growth since 2013.

Assuming a borrower had a $300,000 loan at the end of the 12-month deferment or forbearance period, they will have accumulated additional interest of $10,500, resulting in a new loan balance of $310,500. Let’s also assume that the property was worth $330,000 at the beginning of 2020, which means the equity balance would be $19,500. A modest year-over-year appreciation estimate would price the same property at $360,000 today, leaving homeowners with $49,500 in equity. What this means is, even if we see the number of defaults increase once the forbearance and foreclosure moratorium programs end, the record level of homeowner equity would translate into the overwhelming majority of distressed assets to be sold well before the foreclosure auction.

Reason 3: Foreclosure process is drawn out in some states

Given the recently announced extensions to both foreclosure moratoriums and forbearance plan terms, it makes sense to look at the share of excess serious delinquencies (90 plus days) that are likely to trickle into the market and over what timeline. After adjusting for equity gains, the most immediate supply could come from some portion of 2019 volume becoming available:

Source: *BlackKnight Financial Technology Solutions

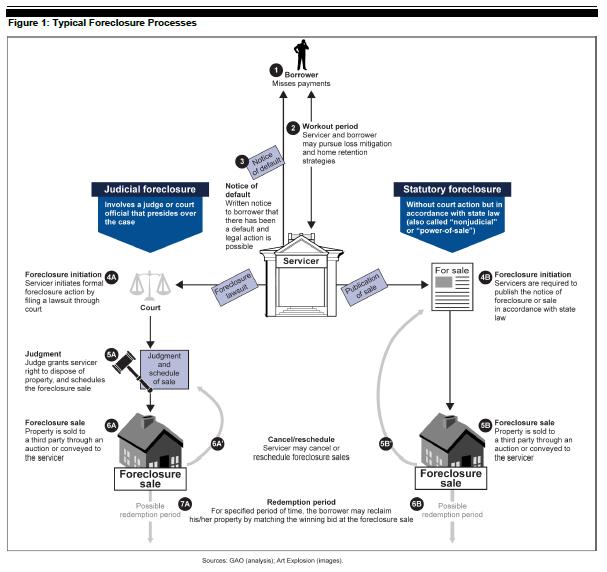

The speed with which the foreclosure process can unfold varies by state and depends on whether the property is located in a power of sale jurisdiction or judicial foreclosure jurisdiction. The foreclosure process in a power of sale jurisdiction can go fairly quick, in 3 to 4 months, however, the foreclosure process in a judicial foreclosure state can take years if the homeowner files a response to the foreclosure summons and delays the court’s judgment. *BlackKnight Financial Technology Solutions

Some states, like California, have recently passed legislation that makes significant changes to the non-judicial foreclosure process as well. California’s SB 1079 which creates “redemption rights” for trustee sales, is likely to slow down the process, eliminate pricing distortions and flipping opportunities historically introduced by distressed inventory, and can expose buyers to unforeseen risks, but draws out the foreclosure process.

Related: Facing Foreclosure? 5 Things You Need to Know

Today’s defaults will not lead to tomorrow’s foreclosures

When borrowers default on a loan, it’s not unusual for the default to be resolved before the foreclosure. Today’s environment is much more favorable than what we saw during the last recession, and homeowner equity is at an all-time high. According to CoreLogic, homeowners with mortgages have seen their equity increase by nearly $1.5 trillion since Q4 2019, an increase of 16.2% year-over-year. At the end of June 2020, more than 90% of borrowers in forbearance had more than 10% equity in their properties.

Homeowners with sizable equity, coupled with historically low inventory of homes for sale, low mortgage rates, and strong demand will be able to sell their properties easily at a modest discount if they want to avoid foreclosure.

At this point, it’s hard to estimate true distress as borrowers and renters fall into two categories: those who experience actual distress and those who have figured out how to take advantage of the situation by either avoiding payments or eviction while enjoying free housing.

We are likely to see a rise in mortgage defaults post COVID-19 pandemic, but as recovery continues to gain momentum, with job gains and GDP growth, confidence in the housing market remains high and will keep muscling through. Most properties will likely sell before going into foreclosure. There might be a trickle here and there, but a flood is highly unlikely.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.