What to Expect from Prices, Wages, and Real Estate Investors When Inflation Rises

As we watch food prices go up, oil prices rise, and historic amounts of money get pumped into the U.S. economy through monetary policies, inflation worries and speculations have sparked messy debates among all market participants. There are good arguments on both sides of the ‘will inflation stay or go?’ discussion. In either case, residential real estate has proved to be a haven during periods of high inflation. Economists studied U.S. inflation of the 1970s and discovered that home prices continuously went up relative to the size of the economy, while stock prices fell, meaning homeowners were better off relative to stock owners.

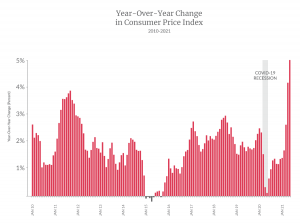

Inflation is something most people hear about, but few actually understand. And we’re at a time now where prices consumers pay are going up. In fact, December 2021 marked the fastest rise since 1982.

The Bureau of Labor Statistics announced this week that the consumer price index (CPI) increased .9% in June after rising .6% in May for all goods including food and energy, like gasoline.

Excluding the more volatile food and energy components, the so-called “core” inflation increased by 0.9% in June, after increases of 0.7% in May and 0.9% in April. Core inflation includes things like new vehicles, used cars and trucks, apparel, medical care, and shelter.

Used vehicles accounted for more than a third of the CPI gain, while other things associated with opening the economy including hotel stays, car rentals, and airfares also played a part in the spike.

Source: U.S. Bureau of Labor Statistics

But what does all of that actually mean? Read on.

What is inflation?

The textbook definition of inflation is a sustained decrease in the value of money. In practical terms, that means you can buy fewer goods or services today than you could buy yesterday with the same amount of money. This continues to happen day over day, month over month, year over year.

The most egregious example of inflation — or hyperinflation — was in Brazil 30 years ago when people rushed to buy everything they could as soon as the stores opened because inflation was going up 70% to 80% every month. Were that to happen here, you might imagine buying a $1 LED light bulb at IKEA in January, paying $2 for the same item in February, and then having it cost $1,000 in December. Yikes!

Thankfully, the U.S. has never dealt with anything as dramatic as Brazil’s hyperinflation. The U.S. had double-digit inflation in the 1970s, but it was far from “hyper.” The country’s 12-month high of 13.3% occurred between 1978 and 1979, a time when oil and food prices climbed due to supply issues and monetary policies that stimulated higher demand. Still, inflation can have very real consequences on the overall economy and your pocketbook.

What’s so scary about inflation?

More than 75% of American consumers are concerned about inflation, according to Civic Science data. In addition to impacting the cost of living and quality of life, it distorts pricing mechanisms.

When inflation is unpredictable, it’s challenging for business owners to determine what to charge for goods and services. Price discovery costs, or the process of determining the price of an asset, start piling on. Imagine the time and energy a restaurant owner needs to re-print a new menu and research how much to charge for every single ingredient and dish.

Price distortion of goods and services caused by hyperinflation, or even a double-digit inflation, impacts everyone. Workers, investors, and business owners spend a lot of time trying to forecast inflation and its impact on the cost of goods and services. Currently in the U.S., inflation expectations are particularly high for rent at 9% and gasoline at 9.6%.

Another scary side effect of inflation is the way it can create a redistribution of income given that it does not have an equal impact on all population groups. Those with student loan debt who have a fixed interest rate on their student loans will be able to pay their debt faster with higher inflation. Historically, that group also has a higher income than people without debt. This means high inflation redistributes the wealth to people with higher lifetime income.

Inflation can also exacerbate the pandemic’s impact on homeowners and renters. For example, people who entered forbearance — meaning they missed or reduced a debt payment under protection — during COVID-19 or lost their job and couldn’t refinance their mortgage with a lower interest rate are at a disadvantage. That’s because one way to tame inflation is to raise interest rates. In a post COVID-19 world, people’s monthly shelter costs, both new homeowners’ (or those who couldn’t refinance under previously lower rates) and renters’ will be significantly higher.

What does COVID-19 have to do with inflation?

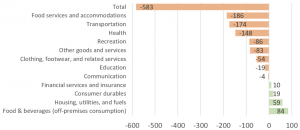

Multiple lockdowns slowed down global supply chains. Some sectors were hit more severely than others, but all were affected in one way or another. For instance, demand for certain recreational activities increased in Q4 of 2020 (see chart below) as people had to take care of their mental health and didn’t need to commute to the office. Demand for clothing, as people spent more time at home, went down.

How Spending Changed by Sector During COVID-19 (in $ billion)

Source: BEA and World Data Lab projections for Q4 2020

Factors such as currency appreciation, taxes, subsidies, sanctions, and supply chain disruptions all go into the cost passed on to consumers. Pandemic-related changes in lifestyle — like job loss or stay-at-home orders — also impact disposable income, and can change spending habits, especially in the long-run.

Adding fuel to the fire is government stimulus money, which increased the amount people have available to spend. Usually, when money supply increases, people increase their spending. Inflation is only inflation if supply can’t keep up in the long run, and if money supply increases without growing the economy.

What is the inflation debate about?

Post-pandemic, price trends are hard to summarize. Everything from computer chips to lumber are in shortage. When people demand more goods and services than producers can generate, there aren’t enough goods and services to go around. The market solution to that problem is higher prices. And that’s what’s happening. Simultaneously, stimulus money increased the amount people have available to spend.

Will this post-pandemic rate of inflation last?

In the long run, producers usually figure out a way to increase supply to meet demand. If and when this happens in a post-pandemic world, there’s good reason to think this current inflation is “transitory,” or temporary, until the supply shortages subside. Of course, the rate of inflation may not be uniform across all goods. History shows that even if prices fall for some items (like those that can be disrupted by technology), overall prices tend to remain permanently higher. In other words, even when inflation spiked on a year-over-year basis but then normalized, prices remained at similar levels, meaning inflation was transitory (or short-lived) in the rate of change, but not absolute terms.

Real estate is a hedge against inflation

The first and most important characteristic of real estate in an inflationary environment is that it’s a scarce asset. In other words, it’s an asset that is naturally limited in supply, and it serves fundamental human needs. As inflation numbers go up and prices for other needs go up, fixed monthly mortgage payments for previously purchased property remain the same. Not only that, but real estate has the ability to earn income through rental payments that can be adjusted as prices go up — a boon for investors or homeowners who choose to rent. That’s why single family rental operators are deploying billions of dollars to buy rentals. The best and simplest concept to understand is hotels. They have nightly lease terms. If inflation rises, hotels can immediately adjust rates. While yearly rent can’t be adjusted quite as quickly as a night’s hotel room, it does respond to market forces.

Is inflation here to stay or go?

Why inflation might be temporary:

- Many supply shortages are a result of demand recovering quickly. The supply bottlenecks will be figured out by the producers.

- There is a lot of pent-up demand and now that, as of early July 2021, 67% of adult Americans have received at least one dose of the vaccine and are ready to enter the world again, people will be spending more money.

- Demographics behind increased spending are very strong. Meaning, as the economy opens up, more short-term demand will come from younger generations who are hungry to travel and buy clothes.

Why inflation might be here to stay:

- There is evidence of rising wages. Once wages go up, employers can’t ask workers to take pay cuts or hire new workers at lower pay. This results in higher cost of goods and services that are ultimately passed on to the consumer.

- Current administration has big plans for fiscal stimulus and it could lead to new levels of demand.

- Inflation is a self-fulfilling prophecy. Inflation expectations will play a role in pricing in the assumption of future higher prices. For example, when people see prices go up and expect prices to keep going up, they will go to their boss and start asking for a raise, or they will start looking for a higher paying job. If employers raise wages, they have to up what they charge for goods and services (or simply put, increase prices to offset wage increases). This can lead to inflation.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.