Results of Q2 Sundae Investor Pulse Survey

Active buying surges in June while margins increase across the quarter.

It’s only mid-July and 2020 already feels like a lifetime. The pandemic and its economic, social, and political repercussions have put us all through quite a roller coaster over the past few months. That’s why we’re excited to share the Q2 results of the Sundae Investor Pulse Survey.

This monthly survey goes out to a growing network of around 1,000 property investors. We ask basic questions on buying status, deal financing, and pressing issues that face the industry. Survey responses are particularly interesting when viewed across several months, showing how investor behaviors change over time. The Q2 responses are telling, given the drastic difference in market conditions between April and June.

We hope these results provide real estate investors with interesting data points to help understand the current market. In the coming days, we plan to evolve the methodology and provide even more granular data and visualizations into the real estate investment space. .

Active buying surged in June

When asked to describe their current property acquisition status, survey respondents selected one of three choices:Actively Buying,Cautiously Buying, orSuspended Buying.

In April, during the early days of coronavirus uncertainty, barely of investors reported actively buying houses. By June, this number shot up to more than. Meanwhile, businesses who suspended homebuying went from a high of almost in May to only 2 in June.

The share of cautious buyers declined in every month of the survey, coming in at around 27 of investors in June.

Deals financed with cash on the upswing

An interesting trend uncovered by the survey was the huge increase in respondents reporting that they’re financing new property acquisitions in cash. This spike of 39 in April to 63 in June may reflect investors spending the surplus of cash built up during shelter-in-place orders, when the American savings rate hit historic highs.

Survey respondents citing deals financed with private money, which includes lines of credit, bank notes, and other personal funding sources, went from over 15 in April to below 10 by the end of the quarter.

Buyers increased their margins throughout Q2

We asked investors to provide insight into the top margin they’re buying houses for. We defined margin as “price + rehab / after repair value.”

Responses show that operators were settling for much lower margins early in the quarter. Nearly 60 of respondents said their maximum margin was less than 75 in April, while only 14 of respondents reported the same in June.

On the other side of the profit spectrum, only 2.8 of investors targeted a max margin above 85 in April, while more than 25 were seeing maximums above that level in June.

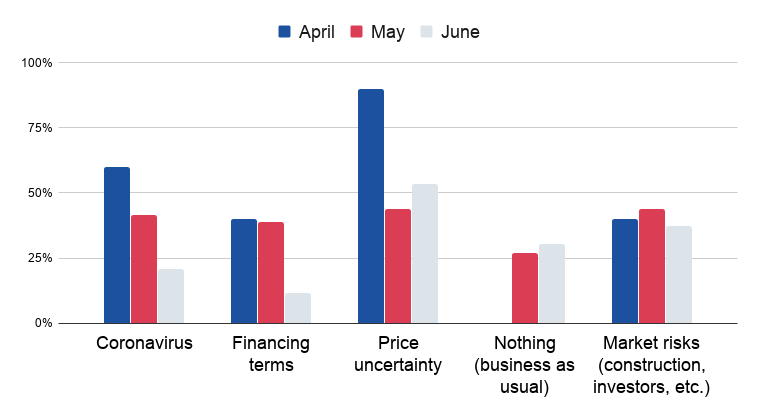

What issues affect your business the most?

The number of investors citing issues related to coronavirus and pricing uncertainty dropped precipitously from April to June. A whopping 90 of respondents were concerned about prices in April, while just over half said the same in June.

The percentage of survey respondents reporting financing terms as their biggest issue was relatively high in April and May (40 and 39, respectively). But that share dropped to 12 in June.

About a quarter of investors surveyed said everything was business as usual in both May and June.

Note: survey respondents were able to select as many answers as apply on this question.

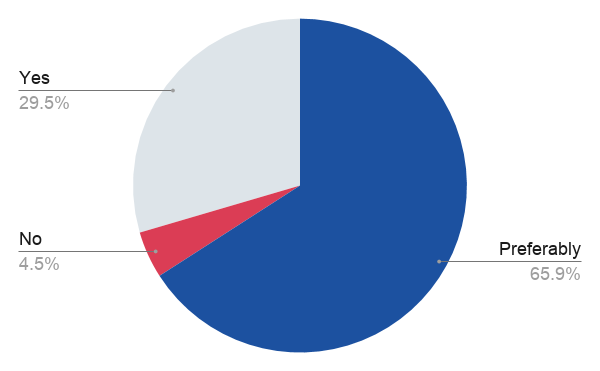

Requiring physical access to a property

As a bonus question, we asked respondents if they require access to a property before buying. We gave them the following choices:

- No, I do NOT require physical access

- Yes, I require physical access

- I prefer physical access but can make my decision with 3rd party inspection report and virtual tour

Nearly 2/3rds of respondents said they preferred physical access but could do without. Just shy of 30 said they wouldn’t buy a property without physical access.

Note: This question was only asked in our June pulse survey.

Discover nationwide properties you won’t find elsewhere

Find, win, and close on exclusive and vetted investment properties.