How to Calculate Net Proceeds From a Home Sale

Net proceeds are the total dollar amount a home seller receives from the sale of a house after accounting for all expenses, holding costs, commissions, and fees incurred during the sales process. Net proceeds calculator included below.

Much to every home seller’s disappointment, the sale price of your property is not the amount of money you actually make. To calculate that number, called your net proceeds, you need to account for the additional costs. These include the costs of hiring a real estate agent, listing the house on the MLS (Multiple Listing Service), and paying transaction fees.

Though it is not an exact science, calculating net proceeds on a home sale is extremely useful. Doing so will help you determine whether or not you should list your house with an agent or consider an alternative. One such alternative is selling your house to a cash buyer. If you’re considering selling your home, this easy-to-follow guide will help you estimate how much money you’ll actually make from the home sale.

1. Start with your estimate

A good first step is to formulate an estimate of how much your property will sell for. This shouldn’t be just a guess or “wishful thinking.” Instead, you need a reasonably informed estimate using data. How do you come up with that? Check local home real estate sites for comparable homes (“comps”) that have sold recently in your area.

What exactly makes a home comparable to yours? A comp is a home with the following characteristics:

- Similar square footage

- About the same number of beds/baths

- Roughly the same age

- In the same neighborhood

- Similar physical condition

If a recently-sold home is in similar condition, is about the same size, has the same upgrades (or lack of upgrades), and is in the same location as yours, the final sale price of that home is the ideal place to start an estimate for your home. If you can find multiple homes that fit this criteria, even better.

Note: Pay close attention to the date of the sale. The housing market changes constantly. Just because a comparable home sold for a certain price last year, doesn’t mean your house will sell for that price today. Try to use comp sales from the past three months, or six months if you’re having difficulty finding examples.

A workaround to using comps

If you can’t find a comparable home that has sold recently, you may have to do some simple cost adjustments to one that has. For example, say you find a home similar to yours except that it has a renovated kitchen. First, try to estimate the cost of the comparable house’s updates using an online tool such as Home Advisor. Next, subtract that estimate from the sale price of the comp to get a good target sale price for your home. In this case, based on the average cost of kitchen upgrades, you can assume your price should be at least $20,000 less than what the similar home sold for.

This step is extremely important to how much money you make on the home sale. Underpricing leaves money on the table, while overpricing usually leads to a long and expensive sales process.

For this article, we will use a sale price estimate of $430,000 to illustrate how to calculate net proceeds.

| Price based on comparables with upgrades | $450,000 |

| Subtract from price based on kitchen upgrade | $20,000 |

| Realistic asking price | $430,000 |

2. Calculate any seller concessions

After arriving at a reliable estimate, you’ll need to start tallying up expenses that will subtract from the sale price. First, calculate any potential seller concessions. A seller concession is a “gift” from you, the seller, in the form of a price reduction. Seller concessions are most often given for necessary repairs found during an inspection, not cosmetic upgrades.

Common seller concessions include water problems, wildlife intrusions, termites, roof needing replacement, electrical defects, or foundation needing repair.

For construction issues, a good baseline seller concession is 1.5%.

| Realistic sale price estimate | $430,000 |

| Seller concession (1.5%) | $6,450 |

| Actual sale price | $423,550 |

3. Calculate transaction costs

They say nothing in this life is free, and that is certainly true for real estate transactions. It is difficult to sell a home on the traditional real estate market without the services of a licensed real estate agent. Unfortunately, agents’ fees aren’t cheap. The typical real estate commission fee is between five and six percent of the sale price (though legally it can vary).

Beyond agent commissions, as the seller you will likely be responsible for paying closing costs to title and escrow companies. Closing costs are all the administrative costs in a home transaction such as fees for attorneys, a title search, title insurance, taxes, and lender charges. These fees add up fast and often reach an additional two to three percent of the home sale.

All transaction costs together will constitute between seven and nine percent of the sale price.

| Actual sale price | $423,550 |

| Transaction costs (8%) | $33,884 |

4. Calculate holding costs

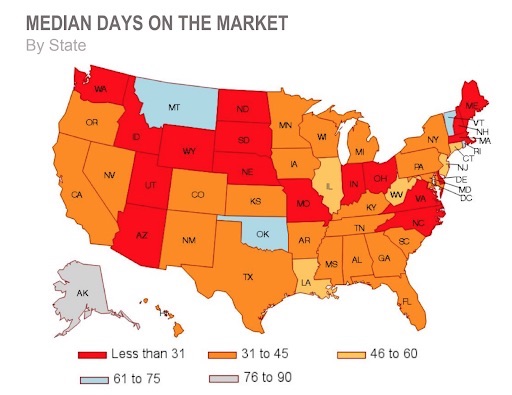

Just because you put your home on the market doesn’t mean you now have a “get out of mortgage free” card. On the contrary, you’ll still be paying mortgage and other typical housing costs for the entire time your house is up for sale. Realistically, your home will probably sit on the real estate market for a while. So you’ll need to estimate what it will cost you during that span. Where your home is located will be a major determinant of what you can expect to pay.

Source: NAR REALTORS® Confidence Index | November, 2019

Obviously, a speedy sale will help you avoid significant holding costs. But in most of the country, homes take more than one month to sell. In fact, the average home nationwide spends between 65 and 93 days on the market, according to data from the National Association of Realtors®.

Beyond the mortgage, you’ll also continue to pay monthly expenses like utilities and HOA fees during this period. Collectively, all of these costs you incur while the home is on the market are known as “holding costs.”

If you’re unable to precisely calculate holding costs based on your known expenses, a good benchmark estimate is 0.7% of the total home value per month.

| Monthly holding costs | $3,010 |

| Months on the market (conservative) | 2 |

| Total holding costs | $6,020 |

5. Calculate total proceeds

Based on the information compiled in the previous steps, you can now begin to calculate what your home sale net proceeds will be after the real estate transaction is complete. Keep in mind, however, that the amounts can change based on many variables; chiefly the state of your local real estate market and the fluctuation of interest rates. For example, maybe commission fees are higher than average in your area, or perhaps interest rates have gone up causing your home to spend longer than two months on the market.

| Realistic asking price | $430,000 |

| Seller concession (1.5%) | $6,450 |

| Transaction costs (8%) | $33,884 |

| Holding costs | $6,020 |

| Total net proceeds | $383,646 |

6. Don’t forget mortgage and soft costs

This estimate does not factor in mortgage or other debts you have to pay off after the home sale. The numbers above show you how much cash you will be left with after all expenses are added up. But if total net proceeds are less than what you owe on your mortgage, you’ll still need to pay off your debt.

While these calculations will help you estimate the dollars and cents involved in a home sale, they don’t begin to account for the “soft costs” associated with the process. For example, soft costs include time, mental stress, and physical labor from activities such as:

- Keeping the house clean

- Having the home professionally staged

- Adjusting your schedule to accommodate showings

- Haggling with potential buyers

- Living with the ambiguity of not knowing if and when your property will finally sell

For many homeowners, the hassle is just not worth the payout. For others, the payout itself may not match the number offered elsewhere. After doing these calculations, you may want to ask yourself what’s best for your situation.

What’s the alternative?

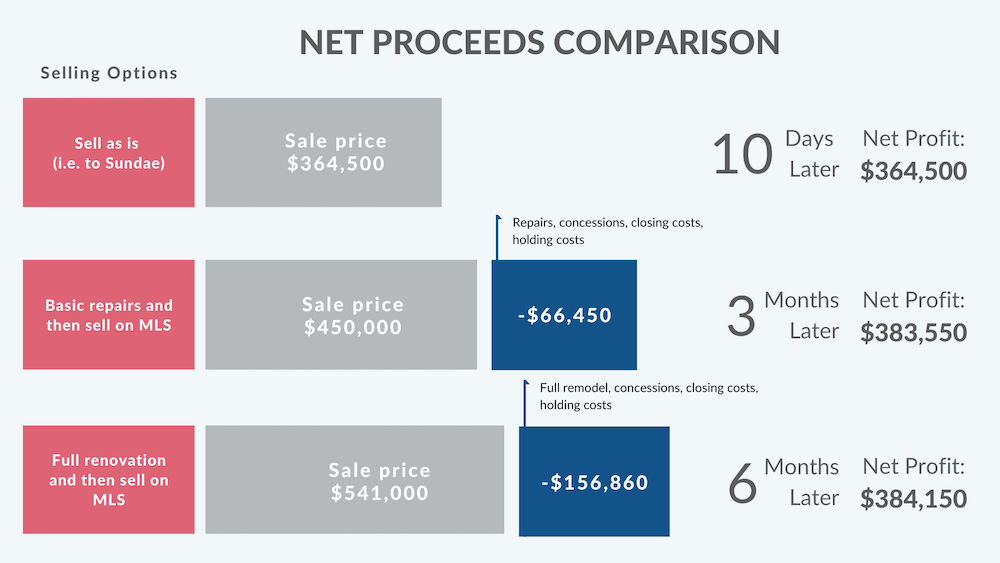

If you decide the sales process is too time-consuming, expensive, and emotionally laborious, you’ll be happy to learn that there are alternatives to the conventional sales route.

Selling your home with an agent can be ineffective and tiresome. That’s why many choose to sell their homes for cash to an off-market buyer. Selling a home off market means the home is never listed on the MLS and is instead purchased directly by an individual or business. An off-market sale is not only faster and easier, it may result in higher net proceeds. If you choose to sell your home on Sundae’s Marketplace, for example, you pay no transaction costs. You may even be eligible to receive a $10,000 cash advance to help you with moving or other expenses.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.