What is an iBuyer?

iBuyers, or iBuyer companies, are companies that will purchase your house quickly for cash, then resell your property. This article explains why “instant buyers” appeal to people who want to sell fast and what to look out for as you make your final decision.

iBuyers explained

iBuyers are also known as “instant buyers.” As the name implies, they can buy your property quickly and give you an instant cash offer based on what they estimate your house to be worth. Then, they turn around and resell your house to another buyer.

What does an iBuyer do?

A typical model works something like this: the iBuyer provides an online tool where a homeowner answers questions and enters key information about their property. Many iBuyers provide no obligation cash offers, allowing homeowners to receive an initial assessment without any pressure to accept. The iBuyer evaluates this information and provides the homeowner with a cash offer for their house after a very short turnaround time (usually less than 24 hours).

Citing speed, convenience, and flexibility as the key benefits, these companies offer an alternative route to the traditional agent-driven process of selling residential real estate on the open market.

Why people sell to iBuyers

People sell to iBuyers, particularly home sellers, for a variety of reasons. Perhaps you want an alternative option to working with a traditional real estate agent. Maybe you just want a no-hassle way to sell your house. Here are some of the most common reasons for choosing an iBuyer:

1. The convenience of selling your house online

The traditional way to sell a house is time-consuming and invasive. Getting a house ready to sell might eat up your nights and weekends. Hosting open houses can disrupt your day-to-day life. Then, you might have to wait an extended period of time to receive an offer.

In contrast, working with an iBuyer is quite convenient for busy people. After running some analysis, an iBuyer can send you an initial offer online within days, streamlining the home selling process.

Compare multiple offers and sell as-is

It makes sense to compare your home's value to others. Get multiple cash offers from local investors, fast. No repairs or showings. No fees to Sundae.

450+ reviews from customers like you who sold with Sundae

2. A way to get quick cash and move on from the house

Going through a long home sale process can become expensive quickly. You’ll need to keep up with your bills, maintain the house, and pay property taxes for example. Every month that your house doesn’t sell can cost you money in holding costs.

iBuyers pay in cash, offering an all cash offer, which gives them more flexibility. That means you can probably close faster (saving you money on holding costs) and get money in your pocket from the sale. It’s in their best interest to close quickly because they want to resell your house shortly afterwards.

3. To avoid traditional real estate agent commissions and save money

You typically pay the buyer’s agent and seller’s when selling a house with a traditional real estate agent. Historically, this commission cost is between 5-6% of the sale price. If the commission was 5% and you sold your house for $500,000 it would cost you $25,000.

While you can use a traditional agent when selling to an iBuyer, you don’t have to use your own real estate agent. Some sellers will forgo using a traditional real estate agent as a way to sell and save money on commission fees.

Popular iBuying companies

iBuying companies operate across the United States with some being larger than others. Some of the biggest iBuying companies are Opendoor to Offerpad.

Zillow is another company that used to be in the iBuying space. Ultimately, they overpaid for houses and lost more than $420 million. Though this may have benefitted sellers, it raises the question of whether iBuying models are sustainable in the long run. These iBuying companies have significantly impacted the real estate market by offering quick and convenient selling options.

What the typical iBuying process looks like

Before committing to anything, it’s important to know how the iBuying process works. That way, you know what to expect along the way.

Not all iBuyers follow the exact same process, but there are certainly similarities. Here are four steps that you’ll likely experience if you sell with an iBuyer:

It’s important to note that offers from iBuyers may be below the fair market value of your home.

Step 1: request an offer

Requesting an offer on an iBuyer’s website shows them that you’re interested in selling. They will then determine whether or not your house meets their criteria. Assuming that it does, you’ll get an offer. iBuyers will evaluate your home based on its condition and fair market criteria.

Step 2: evaluate your options

At this point, you can take some time to review the offer. Compare this offer against other estimates you’ve gathered from real estate agents and complete your due diligence to make sure this is the right option for you.

Step 3: accept or decline the offer

You have the option to either accept or decline the offer. Typically, there’s no price negotiating–it’s a “take it or leave it” offer, unlike a traditional home sale. Let’s say you decide to accept the offer. The next step is to schedule an in-person home assessment with that company. They basically want to ensure that your house is accurately represented and still meets their requirements.

Step 4: choose a closing date

One of the main perks for home sellers of selling to an iBuyer is convenience. If you want to move quickly, they’ll likely be able to accommodate.

Get multiple offers with Sundae

When working with an iBuyer, that company will give you one offer. It could be a great offer or a terrible one. How do you know if there’s nothing to compare it to?

Compare multiple offers and sell as-is

It makes sense to compare your home's value to others. Get multiple cash offers from local investors, fast. No repairs or showings. No fees to Sundae.

450+ reviews from customers like you who sold with Sundae

At Sundae, we take a different approach. The selling experience on Sundae’s Marketplace puts you in the driver’s seat. That way, you can evaluate the best outcome for your situation.

We believe that in order to find the best offer, you need to be able to see what’s out there. In a recent interview, Josh Stech, our CEO explained that:

“Having one iBuyer make you one offer is not the way to get the best price. Nor is calling two or three. You need multiple offers. At the same time, you need the convenience that iBuyers offer.”

When you list your home with Sundae, you have an entire network full of local property investors. From there, all interested parties will place offers. Since they are competing with other investors, it’s common for homeowners to receive multiple offers. Then, you can compare all offers to see which appeals to you most.

Things to consider before working with an iBuyer

There are many pros and cons to consider as you explore different options for selling your house fast during the home selling process. Here are some key questions to ask before selling to an iBuyer.

How do I know that I’m getting the best price?

It’s natural to have a sense of seller’s remorse after your house is sold. You might begin to ask yourself “what if” questions and feel like you could’ve gotten more.

iBuyers usually give you an offer that you can accept or walk away from. However, you don’t necessarily have anything to compare it to. That’s where Sundae’s marketplace comes in.

Sundae is not an iBuyer, our marketplace that let’s investors compete for your house. There’s always a chance to receive multiple offers and then review the highest one, considering the fair market value. Plus, with more competition someone might be willing to pay more than you asked for to beat out another cash home buyer.

Are there any costs when working with an iBuyer?

iBuyers have service fees as part of their business model. This may vary depending on the company, but it could be 5% or higher in some instances.

At Sundae, you don’t pay any seller fees to us. Our mission is to help you get the best outcome when selling your house. Keep in mind that if you have outstanding HOA dues, a mortgage balance, liens, or otherwise you will still need to pay them. The real estate market has seen significant changes with the rise of iBuyers.

Will I get an offer?

You read that question correctly. It’s not a surefire guarantee that you will get an offer from an iBuyer. Each has their own set of criteria used to determine whether you should receive an offer as well as your offer amount.

Remember that iBuyers want to sell your house after they buy it from you. As such, iBuyers generally prefer houses that are market-ready or just need cosmetic updates so they can list them faster. Damaged, dated, and distressed houses probably won’t make the cut.

For people with houses in need of serious work, Sundae offers an opportunity to truly sell as-is without repairs. The reason we can do this is simple: we connect you with our pool of over 20,000 real estate investors who want to renovate your house after buying it.

Many iBuyers provide no obligation cash offers, allowing homeowners to receive an initial assessment without any pressure to accept.

What’s the typical timeline for selling?

There’s no one-size fits all timeline because it ultimately depends on your situation when you sell. With that said, iBuyers can give you an offer almost instantly, providing an instant cash offer. From there, you may be able to close within 60 days.

Sundae offers full transparency throughout the process

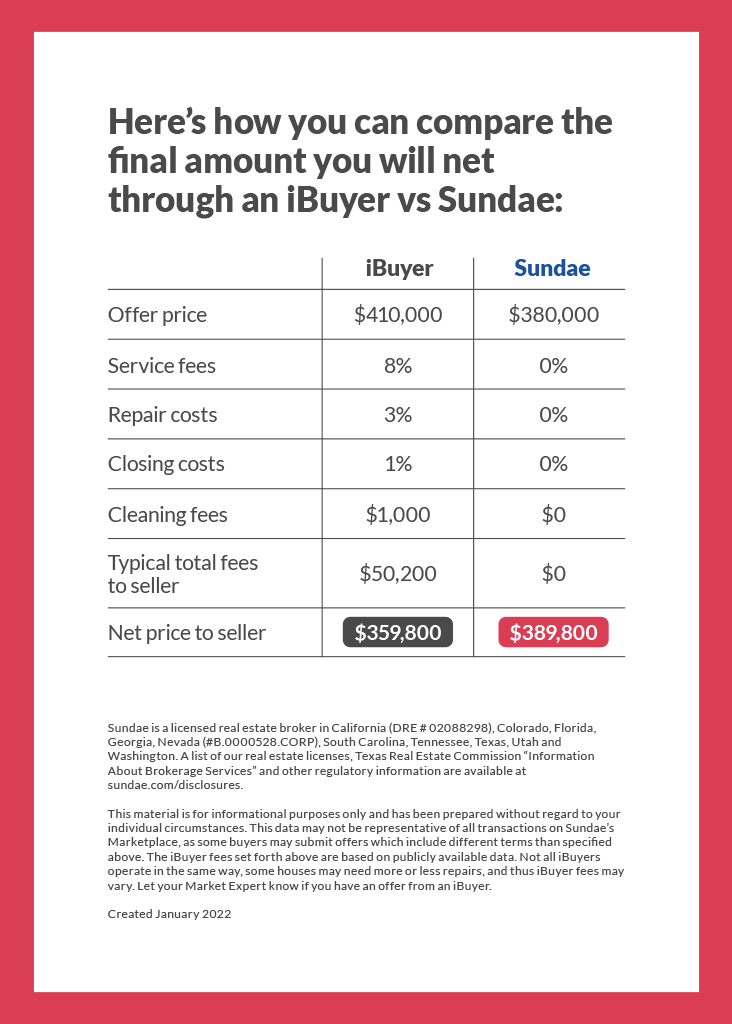

With iBuyers, the price they offer isn’t necessarily the amount you’ll receive. The fees compiled along the way take a dent out of your potential earnings. Let’s say that you receive a $410,000 offer from an iBuyer and $380,000 on Sundae’s Marketplace.

How can this be possible?Fees add up. That’s why Sundae does things differently. Sundae works hard to build trust with homeowners. We believe in providing you with full transparency so that you never feel misled or out of the loop.

Sundae offers a similar closing timeline. When you accept an offer, you can close anywhere from 10 to 60 days afterwards. While you wait for your closing date, your money could be tied up in escrow. That’s why some sellers are eligible for up to a $10,000 cash advance.

Find out how Sundae helps you get the best outcome when selling a home.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.