Top 10 Cities With the Most Reverse Mortgages

For many seniors in America, a reverse mortgage provides a viable way to use home equity to fund retirement. A reverse mortgage lets homeowners over the age of 62 use home equity to provide income without monthly payments. Read our guide on reverse mortgages to learn more.

So, what does the landscape for reverse mortgages look like in the U.S. today? Where are people most likely to tap into this type of loan?

The following 10 U.S. cities have the highest percentage of reverse mortgages, as a percentage of all mortgages. Note: The cities in this list have at least 20,000 single family homes. The data is collected from county recorder’s offices nationwide.

10 Most Popular Cities for Reverse Mortgages

| Rank | City | State | Percent of Reverse Mortgages | Total Number of Houses |

|---|---|---|---|---|

| 1 | St. George | UT | 2.49% | 28,714 |

| 2 | Indio | CA | 0.40% | 21,688 |

| 3 | Winter Haven | FL | 0.31% | 29,998 |

| 4 | West Valley | UT | 0.30% | 24,001 |

| 5 | Albuquerque | NM | 0.27% | 58,979 |

| 6 | Mission Viejo | CA | 0.27% | 25,379 |

| 7 | Menifee | CA | 0.27% | 29,730 |

| 8 | Salt Lake City | UT | 0.26% | 93,091 |

| 9 | The Villages | FL | 0.24% | 49,130 |

| 10 | Sandy | UT | 0.23% | 32,995 |

10 Most Popular Cities for Refinanced Mortgages

If you’re looking for another way to raise money for retirement, beyond the reverse mortgage, you may also consider a mortgage refinance. A refinanced mortgage provides you a new loan with a new mortgage rate, new loan length in years, and new amount borrowed. In essence, it lets you tap home equity to create a more favorable set of terms. When rates are low, a mortgage refinance can drastically lower your monthly payment and provide access to cash to use however you see fit.

There are generally three types of mortgage refinances:

- Standard refinance (rate and term refinance) – Only the interest rate and/or loan term change

- Cash-out refinance – Increases the amount borrowed, changes the terms, and lets the homeowner take cash out at the closing table

- Cash-in refinance – Works the opposite way of a cash-out refinance, where the homeowner changes the rates and/or terms and pays more money toward the mortgage

The following 10 U.S. cities have the highest percentage of refinanced mortgages, as a percentage of all mortgages.

| Rank | City | State | Percent of Reverse Mortgages | Total Number of Houses |

|---|---|---|---|---|

| 1 | West Valley | UT | 3.77% | 24,001 |

| 2 | Billings | MT | 3.59% | 30,639 |

| 3 | Jefferson City | MO | 2.55% | 22,177 |

| 4 | Clearfield | UT | 2.35% | 21,138 |

| 5 | Ogden | UT | 2.34% | 50,485 |

| 6 | Albuquerque | NM | 2.08% | 58,979 |

| 7 | Nampa | ID | 2.03% | 33,416 |

| 8 | New Bern | NC | 1.92% | 22,555 |

| 9 | St. Peters | MO | 1.86% | 23,923 |

| 10 | Snellville | GA | 1.43% | 26,935 |

Using Your Home to Fund Retirement

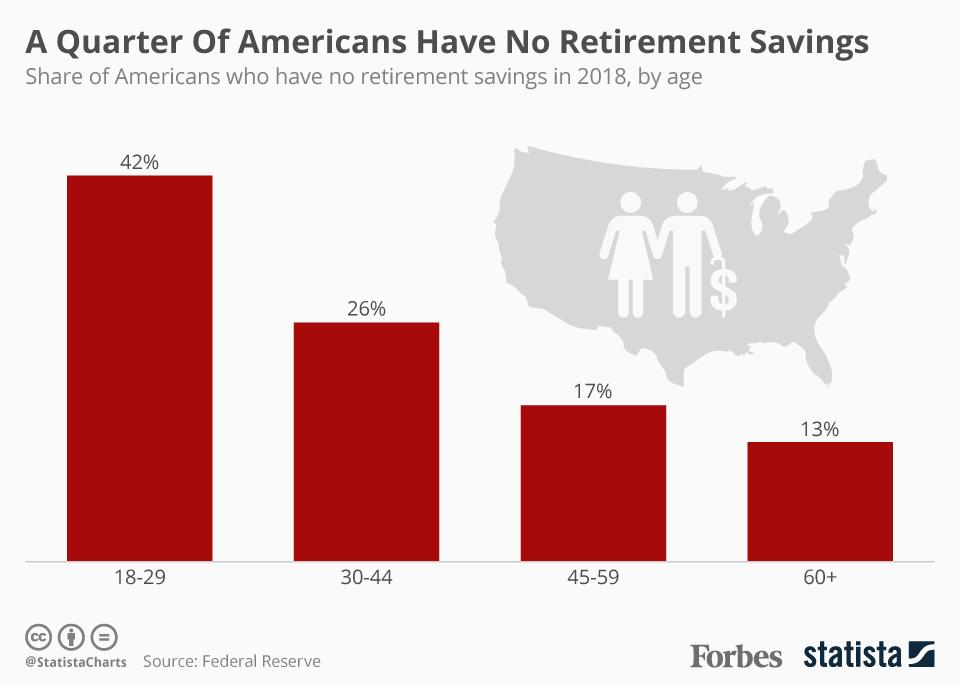

According to data from the Federal Reserve, about a quarter of Americans do not have money saved for retirement. This is an alarming trend signalling that more people closing in on retirement may need to come up with creative funding sources.

In addition to reverse and refinanced mortgages, there are several other ways to use your home to boost retirement savings or to raise money for other needs. Here is a list of some of the most common ways to use your home to raise money:

- Reverse mortgage

- Mortgage refinancing

- Home equity loan

- Home equity line of credit (HELOC)

- Selling for cash

Each of these options has its own pros and cons. It’s important to do your homework before using your home to raise money. However, if you are interested in selling your house to an off-market buyer, Sundae can help. At Sundae, we help homeowners sell houses in any condition as is, and you may be eligible to receive a $10,000 cash advance to help you fund relocation or other expenses. Contact Sundae today to learn more.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.