Is Your Home Your Secret Retirement Savings?

Keeping up with the expenses of daily life is hard enough without having to also think about saving enough for a comfortable retirement. But in 2020 America, millions of workers are facing this dilemma.

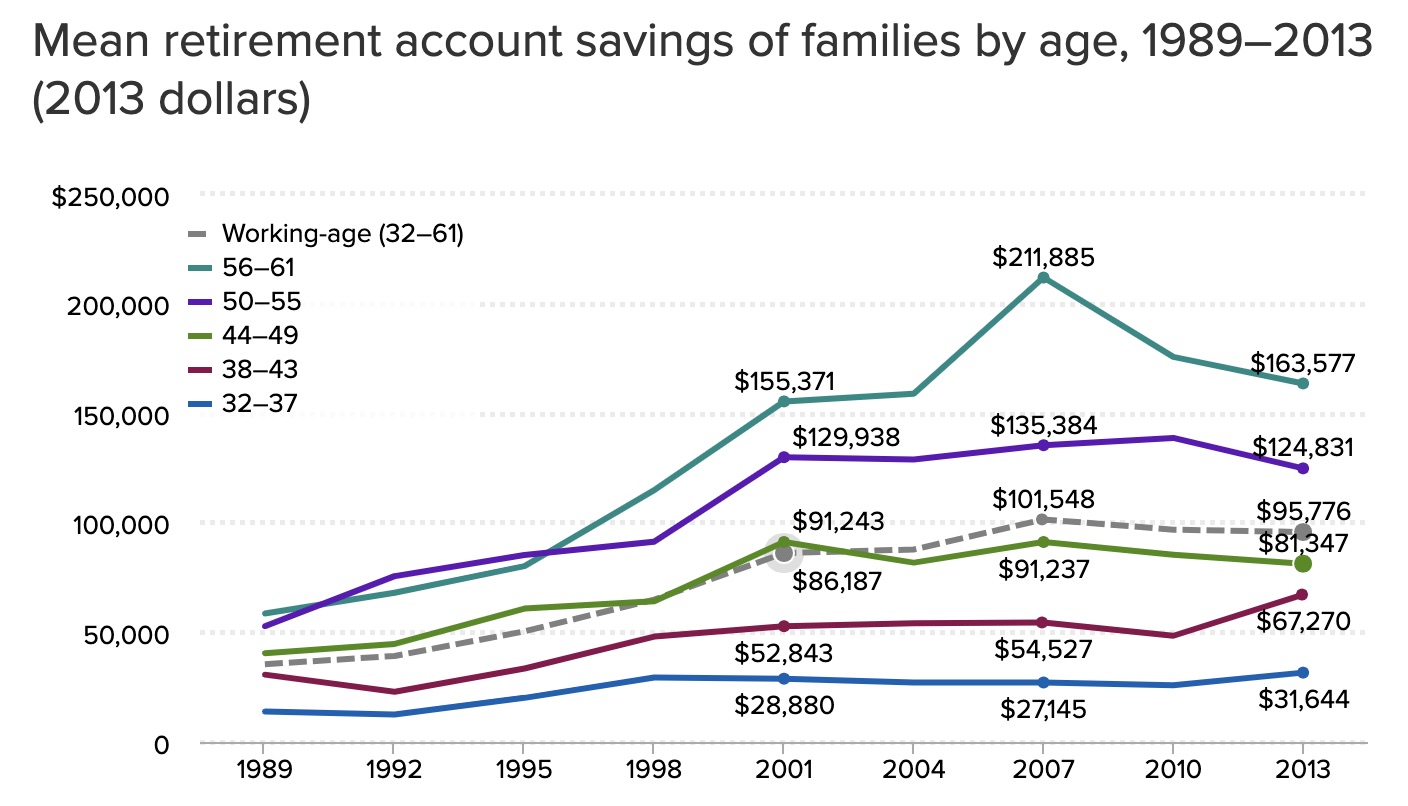

According to the Economic Policy Institute, most American families have little or no retirement savings. As costs of living — in particular housing — consistently rise, the amount most families need to fund their Golden Years also continues to increase. Assuming you want to maintain your current standard of living, you may need 20 to 25 times your annual salary set aside to feel confident. Through this lens, saving for retirement can appear a daunting challenge.

Source: EPI analysis of Survey of Consumer Finance data, 2013.

Saving more of your income and creating an investment plan are important steps to take. But to get another significant boost, you might also consider selling your house. If this is an option for you, here are five tips for using your home to boost your retirement savings.

1. Find out how much your home is worth

Before rushing to sell your home, you want to know how much it’s actually worth. You’ll need an exact number so you can decide how much it can contribute to your retirement goals. If your home is a significant asset, it may help you reach your retirement goals by selling it and renting elsewhere. But if it’s not worth as much as you want, it probably makes more sense to keep it.

The wild card in this decision is the overall state of the economy and housing market. If you suspect a market cooldown is approaching, you might consider selling your house before a full-fledged recession. If you still have time on your side, however, you can probably wait out the next downturn.

Further reading: 9 Red flags that your property value is sinking

2. Assess your mortgage debt

Whether your home is paid off or if you still have a mortgage can affect your decision in a few ways. If your home is paid off, you can likely net more profit now. But remember, you still need a place to live, and you will need money to rent a new place and move.

If you still have a mortgage you may take less of a profit when selling it, but renting could still be more affordable. Depending on the area and your expectations of how in demand your property is, selling may help you reach your financial goals with retirement. It’s important to do the math before deciding.

3. Prioritize your current daily needs

A home can help you bring shelter and comfort to your family. If you still have kids or other family members living at home, that may sway your decision to keep the home. Think about the property itself. Do you need a yard, driveway, or storage space? Try to decide what you can and cannot live without before you make your final decision.

If you are an empty nester and nothing — other than emotional attachment — is tying you to the home anymore, that could mean you have more freedom to sell and do what you want with it.

4. Decide when you plan to retire

Selling a large asset like a home can be a huge decision and shouldn’t be made lightly. You want to consider all the pros and cons. If you want to sell your home to boost your retirement savings, look at how close you are to retirement age. Do you have many years of working left? Or, are you currently nearing retirement age and the profits from selling your home can get you there there faster?

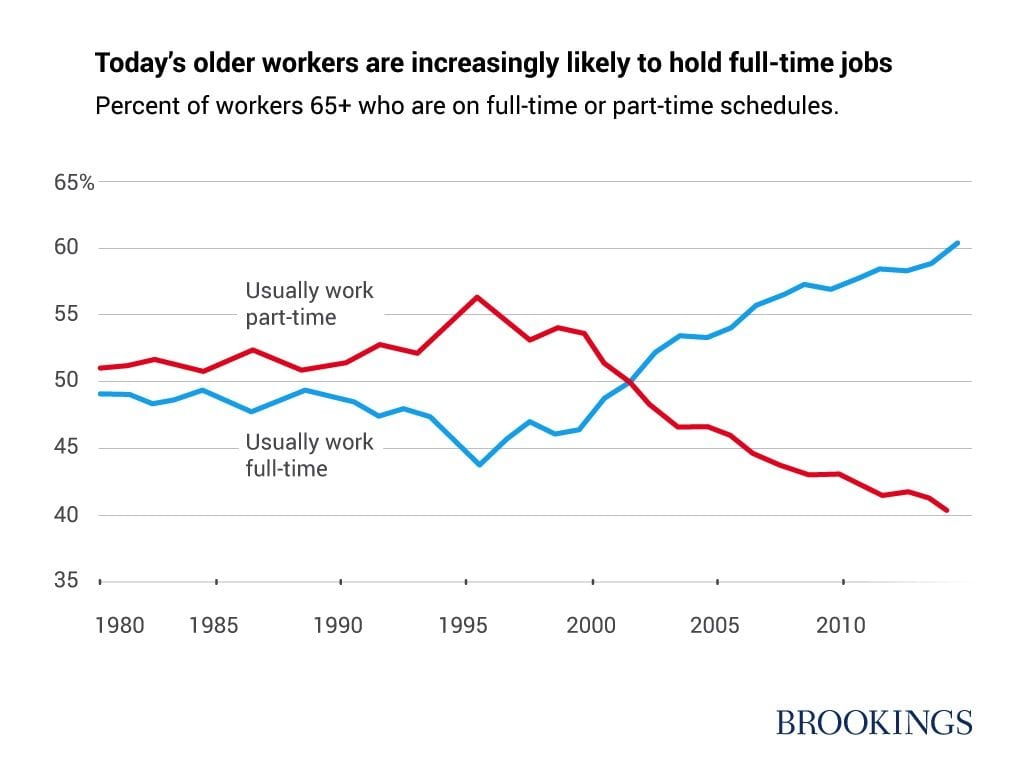

You’ll need to keep in mind access to healthcare, nearness to family, and what you plan to do with your time once retired. Some studies (see below) have shown that more Americans are continuing to work full time past the average retirement age of 65. Your working situation may play a role in your calculations.

5. Consider alternative selling options

5. Consider alternative selling options

Let’s say after answering all these questions, you (and perhaps a trusted professional) decide selling your home makes the most sense to help you reach your retirement goals sooner. You know that maintenance and repairs are costly and you know for your situation, you could use the money you get from selling to help pad your retirement savings.

You might work with a real estate agent, which will eat up six percent of the sales price. Due to the nature of the listing process, it could take some time to prepare your home to sell, and even afterward it could be on the market for a while, which drives up holding costs.

As you consider which route may give you the best financial results, keep in mind that selling to an off-market buyer may be an attractive option. Working with Sundae can help you sell your home as-is, without a time- and resource-intensive process. No realtors. Just a straightforward, transparent sales process without all the traditional hurdles. We work at a larger scale which helps us stay competitive in price. You may also be eligible for a $10,000 cash advance to help you move.

Bottom Line

Retirement is a long-term financial goal. But if you don’t have a ton of time on your side or you’re already retired and need more cash, selling your home can make sense. It’s a big decision that should be made carefully but if you go this route, there are options available to can help you make the most of the situation.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.