2021 Housing Market Trends: Another Year of Growth

The roller coaster ride of 2020 is, thankfully, now over. Here’s what to expect from the housing market in 2021. Spoiler: we’re optimistic.

At the end of 2020, we’re far from the gloomy uncertainty we faced back in March. In the early part of the year, which now seems a lifetime ago, markets cratered and we watched in horror the rapidly-rising COVID numbers and mounting weekly jobless claims.

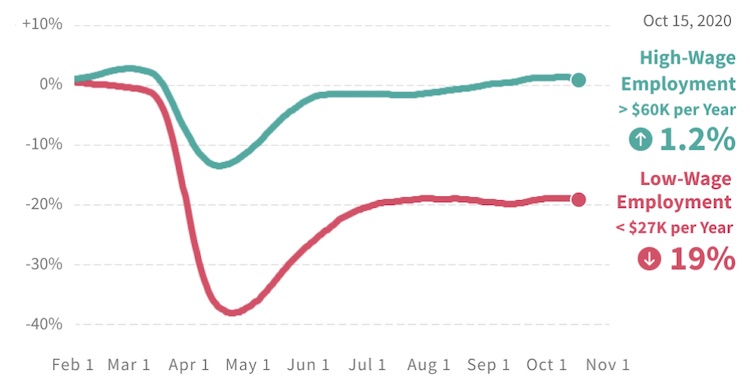

In the past nine months since then, the housing market proved its resilience. In fact, in the second half of the year, real estate was on fire. First, we learned not all job losses are permanent. Then we learned about the K-shaped job recovery, where jobs that earn over $60,000 a year came back and started adding more jobs by November, bringing the total recovered jobs to 56%.

With millions of Americans sheltering in place and dreaming of home upgrades, the savings rate went up, interest rates went down, and a surge in desire for more space created a hot housing market. Now, as vaccines become more widely available and jobs continue to recover, 2021 is promising to be another strong year. These six housing market trends show why.

Trend #1: Favorable winds of demographic change are blowing

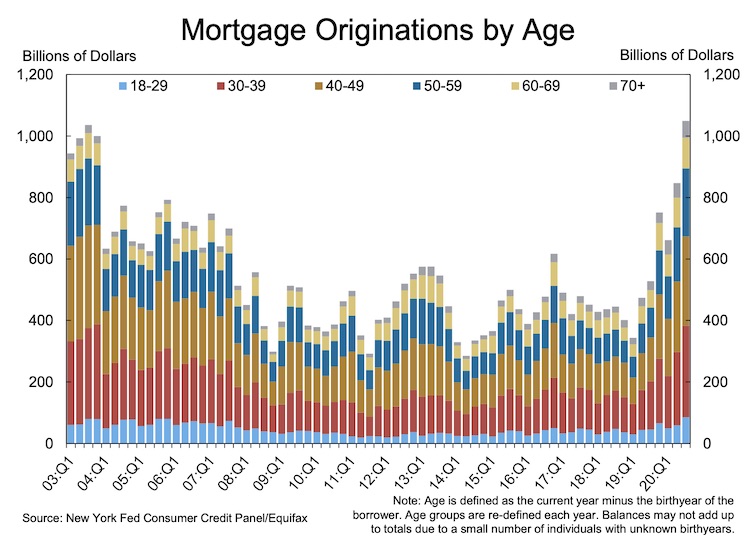

The pandemic hit as the largest demographic in our country entered their prime homeownership years. Despite previous speculations that millennials will live with their parents forever, they now appear to follow in the footsteps of previous generations. With the coronavirus pandemic pulling forward demand for housing, once interest rates fell and made home ownership more affordable, millennials started piling into the housing market.

Ten years ago in 2011, people in their 30s made up around 20% of all mortgage originations. In the 3rd quarter of 2020, that number was closer to 30%. With new FHA limits and a Biden-proposed $15,000 tax credit for first time homebuyers, this trend is likely to continue into 2021.

Trend #2: Say hi to persistently low mortgage rates

Speaking of interest rates, borrowing rates have never been lower. The American jobs recovery decelerated with only 245,000 jobs added in November. If jobs continue to be added at this pace, it will take more than three years to recover to previous employment levels. Meanwhile, the Federal Reserve promised to keep rates low until 2023. This means they’re forecasting a robust recovery that will largely depend on how quickly suffering industries bounce back. Until then, rates will remain low, keeping the cost of mortgages lower than ever before.

Further reading: 5 Biggest Questions for Real Estate in 2021

Trend #3: Business formation + thriving stock market = more wealth

Crisis drives innovation. The pandemic changed how people do business and interact, and presented an opportunity to innovate. According to the U.S. Census, new business applications were up year-over-year almost 32% in the U.S at the end of 2020, with “High-Propensity Business Applications” growing almost 19%. Such numbers are a proxy for job creation and economic growth for the next several years.

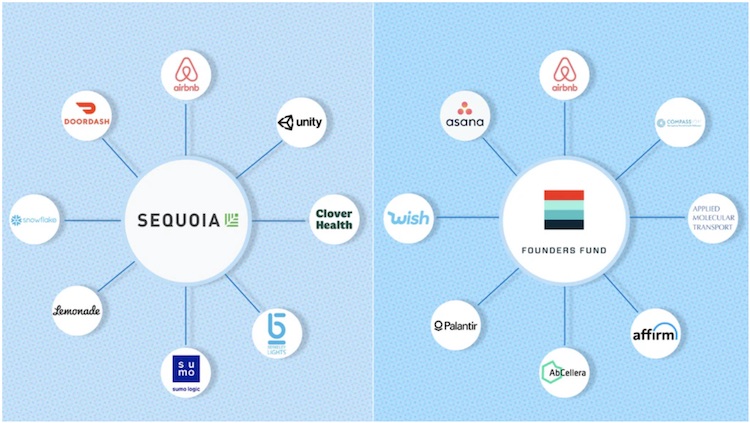

These indicators, coupled with recent IPO activity that returned billions of dollars to investors, position labor markets well in 2021. We think the most successful venture capitalists of the year will continue to thrive as more companies go public in the first few weeks of 2021. And they’ll be looking for new companies to fund to put their money to work.

2020 ended with 104 tech companies going public, not only as IPOs but in direct listings and mergers with special purpose acquisition companies (SPACs), according to Dealogic data. Many firms took advantage of the booming stock market. It’s important to remember that behind every news story of an IPO, many of that company’s employees make a lot of money. These exits result in big liquidity events (i.e. cash windfalls) for a lot of individuals, all of whom look to spend their money around the economy and to purchase or upgrade their homes.

Read more: How the Opendoor IPO Impacts the Future of Real Estate

Trend #4: Home equity reaches healthy levels

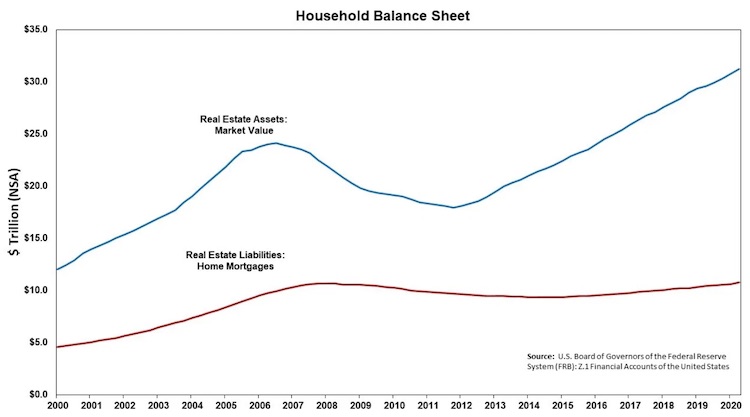

Home equity is the biggest indicator of wealth. Over the last 10 years, property values consistently rose while mortgage debt levels remained stable. Mortgage debt has changed very little from 2006 levels, while home values have risen over $9 trillion in that time period. This means homeowners are in excellent financial shape, relatively speaking.

While first-time homebuyers face barriers to homeownership such as affordability and college debt, move-up buyers and baby boomers looking to downsize are benefiting from this wealth-building trend. Combined with low interest rates, rising home equity will propel sales activity in higher price ranges and markets popular with retirees.

Another reason healthy home equity is important is because it protects the housing market from declining property values due to the presence of distressed homes. For example, if there is enough equity in a home, a homeowner who fell behind in payments due to COVID will still have enough equity to sell at a profit instead of facing a foreclosure or short sale.

Trend #5: City exodus hype proves overblown

You’ve probably heard the tales or seen the stunning headlines. Terrified of viral contagion in dense areas, people are fleeing cities in droves. Big cities are hallowing out as a result, with businesses closing down in record numbers, crime rising, and urban decay setting in. It all sounds too horrible to believe. Thankfully, for the most part, it isn’t true.

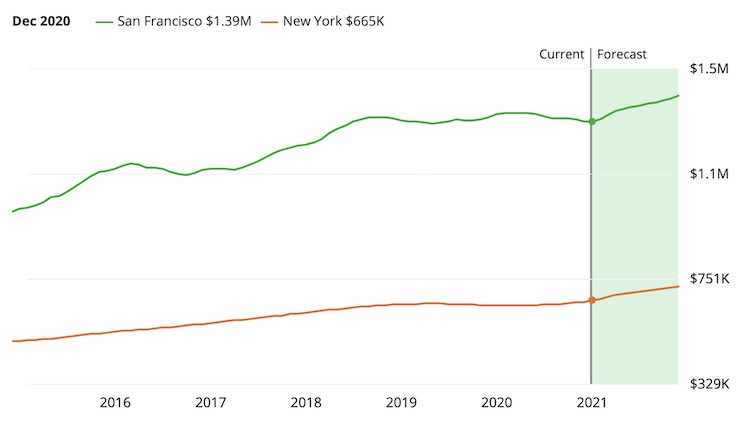

Yes, urban areas have seen better days. San Francisco and New York, in particular, experienced drops in rent and housing prices for the first time in years, thanks to sagging demand. And though there still isn’t much reliable data on it, it’s true that many urban residents around the U.S. have temporarily sought the bigger spaces and lower cost of living of rural areas.

But as our numbers told us earlier this year, demand for housing (and sales prices) in major American cities actually went up in 2020. Now, as virus fears subside and treatments continue to improve, we see the desire for metropolitan living only increasing in 2021 and beyond. For those who decide to depart the city, a common destination will be nearby suburbs rather than remote locations (see more below in Trend #6).

After a lost year with fewer in-person experiences, people will flock back to culture, restaurants, and the attractions of cities that brought so many there in the first place. More importantly, the infrastructure, transportation, and physical capacity of cities never left and cannot easily be replaced by the suburbs or other far-flung areas. As a result, urban areas, especially those with critical technology, science, and healthcare sectors, will see an unprecedented flourishing in the months and years ahead.

Related: Best Cities With Healthcare and Life Sciences Industries

Trend #6: The WFH economy comes of age

The sustainability of the work-from-home trend is a much debated topic. There tend to be two camps: one that thinks it will never work in the long-term, and another that thinks it’s here to stay forever. It’s still unclear which side will win the debate, but the pandemic certainly brought some things into focus.

For example, many workers who aren’t ready to bet that WFH is a permanent fixture, realized during the pandemic that they needed an extra bedroom, office, or playroom to put their kids. Instead of heading for the hinterlands, many of them hedged by moving within the same geography, still close enough to work in the city when normalcy returns.

As the economy opens up, it will take time to figure out whether it’s necessary for everyone to return to an in-person office routine. We see many workers needing to live or work in big cities to be productive, while some remain in cost-effective areas and work from home permanently. No matter how it breaks down, the remote work trend will change housing dynamics for the entire country. With low interest rates and an outperforming stock market, the WFH demographic looking to upsize their housing will continue driving demand upward in 2021.

—

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.