5 Biggest Questions for Real Estate in 2021

Housing markets weathered a challenging 2020 with a strong second half. But will the positive trends hold? Here are the 5 biggest questions for real estate, and who should care most, looking ahead to 2021.

As the saying goes, hindsight is 20-20. But this year most Americans will be pleased to literally put 2020 into hindsight. With a turbulent year drawing to a close, we’re keenly aware of the new constant that colors the real estate industry: economic uncertainty.

In the spirit of seeking truth, we offer the following list of most pressing questions facing real estate in 2021. Answering these five big questions will provide critical insights and unveil meaningful opportunities for any buyer, seller, investor, wholesaler, or real estate professional with an eye on the housing market.

Question #1: What will happen to non-forbearance mortgage delinquencies?

Who should care: Wholesalers and flippers

Not all delinquent loans entered forbearance in the aftermath of the COVID shock. In fact, wholesalers and flippers should watch closely those mortgage delinquencies not in forbearance. As the economy continues to struggle, distress is likely to trickle into the housing market despite its resilience in 2020.

One reason for this is that not all mortgages received forbearance protection provided by the CARES Act. For example, jumbo mortgages, non-qualifying mortgages, and portfolio loans — mortgages not sold on secondary markets — cannot enter into forbearance.

According to recent Black Knight data, out of more than 3.8 million delinquent mortgages about 24% are not in forbearance. Mortgages delinquent 90 or more days are likely to reflect people who lost their jobs permanently.

Read further: Urban Land Institute Report

Investors might want to keep an eye on mortgage delinquency data from the Consumer Financial Protection Bureau. As of late 2020, the data is only updated through March, so it doesn’t yet factor in the effects of the pandemic. Entering the new year, however, this is an extremely important trend to watch as a big increase in delinquencies will likely reflect changes in distressed housing supply in 2021.

Question #2: Will rents for single-family residences continue to increase?

Who should care: Single-family rental investors

Single-family rentals provide great investment returns in two ways: through appreciation and rental income.

Related to the first, housing markets have been appreciating throughout the pandemic with homebuyers taking advantage of low interest rates. We expect this home price appreciation trend to persist in 2021, especially with the incoming Biden administration planning to extend a $15,000 tax credit to first-time homebuyers. This will drive demand, and subsequently push home prices up.

This could also ensure that single-family rentals continue to be a lucrative investment as rents keep increasing. Single-family rental investors should focus on suburban markets looking for older millennials and younger Gen X’ers banking on new work-from-home trends. This demographic plans to commute to work a couple of times a week at most once the economy re-opens and office life again becomes normal.

Read further: Green Street Advisors

3. Are condos a viable option for buyers making the homeownership leap?

Who should care: Young homebuyers

The new year looks like a good time to buy a condo. Supply of condos relative to single-family homes due to the desire of privacy during the pandemic was bigger compared to last year. At the end of November, condos were selling at a record 17% discount compared to single-family homes. Since the situation with COVID is likely to improve once vaccines are administered, this discount represents a good opportunity to buy if you’re betting that life will eventually revert to normal.

4. When is it safe to move back to the city?

Who should care: Small apartment landlords

Investors in urban income properties should watch moving patterns closely. Younger millennials have been moving back home, but not necessarily to escape urban centers permanently, according to USPS mail forwarding data. They might decide to stay with family in less populated areas for health and safety reasons.

Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, told Business Insider in September that even with the vaccine by the end of 2020, he didn’t see the return to a pre-pandemic sense of normal until late 2021 or early 2022. With the Pfizer vaccine approved, and the Moderna vaccine authorized as well, watching urban vs. suburban rents will be key to determining when it’s a good time to enter the market.

Source: CoStar

Additional opportunities may become available for 2-4 unit rentals since it’s still unknown how eviction moratoriums and reduced unemployment benefits impacted small landlords during lockdowns. It’s also unclear whether taxes, utilities, and their own mortgage payments pushed landlords into distress.

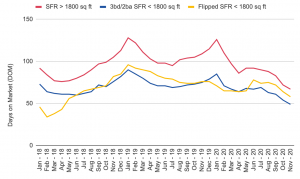

5. How much quicker do standard 3/2 properties sell vs. everything else?

Who should care: First-time homebuyers

With the $15,000 tax credit (mentioned above) and FHA loan limits going up in 2021, we may see a large influx in first-time homebuyers next year. The best way to tell will be to watch what happens with bread and butter properties. A “bread and butter” property is a house that fits the typical mold of most buyers because it has common and popular features. Bread and butter homes are also so called because selling them provides the primary means of income for property investors and homebuyers.

Entry-level, 3 bedroom/2 bathroom homes typically have higher demand than other properties. If they continue to move fast even as price points go higher, this is a sign of especially frothy first-time homebuyer activity.

However, these 3/2 homes must be move-in ready. The current preference of millennial buyers is for updated homes with modern amenities. This means someone needs to renovate them. But there’s a catch. Total DOM (days on market from list to close) for a fix and flip home take a bit longer. This is especially true in appreciating markets, where appraisals are behind the price appreciation trend, potentially putting some hurdles in the transaction.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.