10 Best U.S. Cities to Buy Real Estate

Looking to buy in a market where your house is likely to appreciate? Here are the best cities in the U.S. to buy real estate based on value per resident.

Even when things look bleak, people continue buying real estate. Being a homeowner is part American Dream and part investment. Not a traditional investment, where you put money into something and make more money coming out, but rather the kind of investment that protects your cash, so it’s available for your next large purchase. Plus, we all have to live somewhere.

Many people buy a home hoping it will increase in value, and that the land the home is on will be worth more when they’re ready to sell. This builds equity and provides them a larger down payment for their next home. Homeownership can also be an investment for retirement.

If you’re looking to make a sound real estate investment, the first thing you’ll want to do is select a good location in a healthy housing market. Ideal cities for buying property offer good economic opportunity, housing affordability, and a high amount of existing real estate value.

With that in mind, we parsed tax and census data to identify 10 cities with reasonable home prices and the nation’s highest real estate values per resident. These cities provide buyers and investors an opportunity to affordably own property in the country’s most high value areas. Is your city on the list?

10. Minneapolis, Minnesota

With a median home value of $294,000, and a real estate value per resident at almost $900,000, Minneapolis has a low cost barrier to enter a wealthy real estate market. As of right now, it’s more affordable to own a home in the Twin Cities than it is to rent. The area’s affordability is helping draw in new residents. It’s also making Minneapolis an attractive place for flipping and rehabbing properties.

Even as Minneapolis works to recover from damage to over 1,500 businesses, another attractive quality of the city is job opportunity. With one of the highest concentrations of Fortune 500 Companies in the U.S., Minneapolis and its twin, St. Paul, are home to 17 corporate heavyweights, including Target and General Mills. Buying a home here means owning a share of a nearly $400 billion real estate market.

9. Boston, Massachusetts

Living in Boston means you get the urban feel of New York without the crowding. Buildings aren’t as tall and streets aren’t as packed. Livable neighborhood pockets are easier to find, and the town has a lot of character.

Boston is the most expensive city to live in on our list. With brownstones, apartments, and single-family homes, the median home value is a relatively pricey $498,000. But the real estate value per resident is about $1.17 million. So it’s a good market to own even a small piece of property.

History, sports, and college students are three features of Boston that quickly come to mind. The city’s role in America’s founding is hard to ignore. The Freedom Trail will show you the highlights. As you wander, you’ll pass Fenway Park and The Green Monster. Between Boston proper and it’s across-the-river neighbor, you’ll see more colleges and universities than you can count, including Harvard, MIT, Boston University, and Boston College.

If nothing else, buying real estate here is a safe investment due to the maturity of the market. Boston boasts the oldest median age of house in the country. It’s a bustling town with a rich heritage that’s fun to call home.

8. Bridgeport, Connecticut

Another New England town on our list, Bridgeport has a median home value of $410,000. Neighborhoods include hip, downtown locations close to restaurants, live music, and places to shop, as well as those with a historic feel. Two historic districts are on the National Register of Historic places and attract young professionals, artists, and academics. The real estate value per resident is $1.10 million.

It’s hard to beat Bridgeport’s location. Just 20 miles away is New Haven, one of New England’s more underrated cities. It’s full of history as one of America’s oldest cities, and is home to Yale University. From Bridgeport, you can get to New York in 90 minutes by taking a ferry across Long Island Sound. The city’s location makes it a great jumping off point to all the major cities in the northeast corridor.

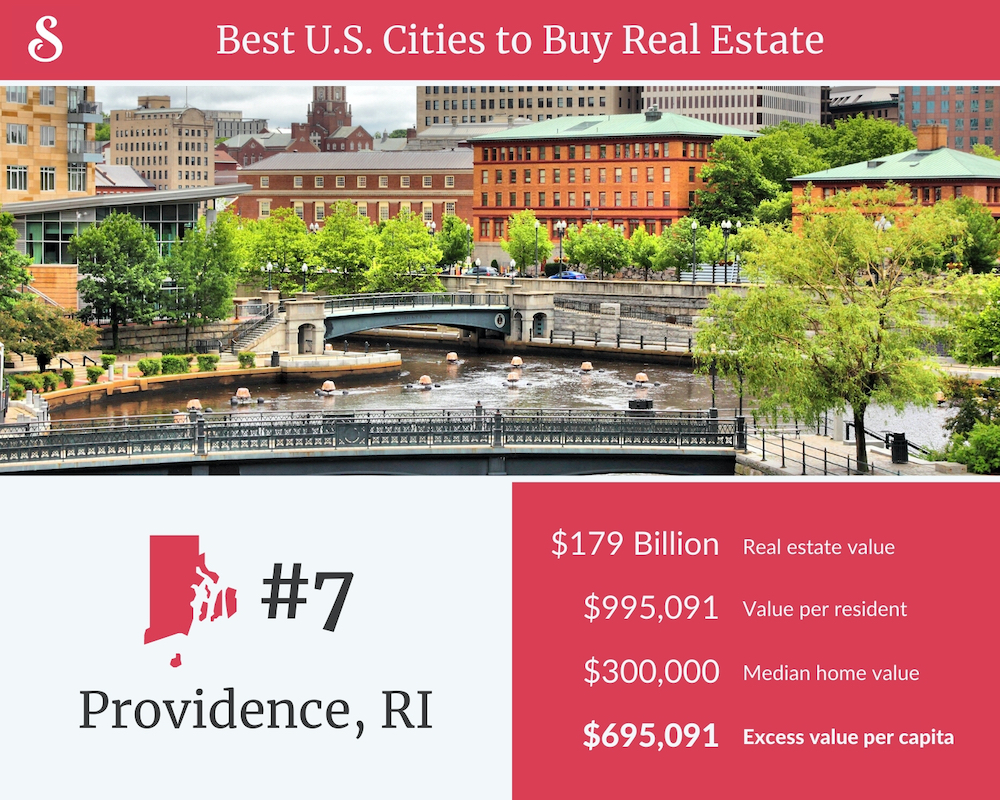

7. Providence, Rhode Island

Providence is that rare New England city with affordable housing and a wide variety of cultural attractions. A median home value of $300,000 means there are plenty of hidden gems available to buyers in all price ranges. With a $180 billion real estate market, this little city in the smallest U.S. state is a good place to own property.

Providence offers many of the qualities of Boston and New York for a lot less coin. Thanks to great public transportation, the town provides easy access to Rhode Island’s 400 miles of coastline and the rest of New England. It’s a city with ample history, culture, and renowned seafood.

From an investment standpoint, low unemployment rate and expanding job opportunities are a draw. Providence is a great college town, packing some well-known colleges into its small space. The city produces a constant flow of young talent from Brown University, Rhode Island School of Design, and Johnson & Wales University.

6. Washington, D.C.

In the past decade, Washington, D.C. has seen explosive growth. Home prices increased substantially as more residents and businesses moved inside the Beltway. Surprisingly, it’s not too late to get a piece of the action. D.C. is still in demand.

The nation’s capital is a thriving metropolis with an incredible diversity of culture for residents to enjoy. Walk by the President’s house on your way to The National Mall where you can see the Lincoln Memorial, U.S. Capitol, and Smithsonian all in one day. The median home value in D.C. is a not-so-cheap $455,000. But D.C. is one of the 10 largest real estate markets in the U.S. by total property value.

Blending a small-town feel with a more cosmopolitan center, this city is a buzz of activity. A huge collection of international communities offers a variety of restaurants and shops to keep residents busy. As a political hub, government plays a big part in everyday life here. But with companies like Amazon setting up offices close by, there is no scarcity of job opportunities.

5. Atlanta, Georgia

A large international city with vibrant commerce and culture, Atlanta is not your typical Southern town. It offers neighborhoods for every lifestyle, whether you’re looking for a fast-paced, urban community, or something green and quiet in the suburbs. One of the nation’s fastest-growing metro areas, Atlanta has plenty to see and experience.

The median home value in Atlanta is $227,000, which is almost identical to the national median. But property here is as diverse as the people. Atlanta is a town where revitalization is constant. Neighborhoods previously on the decline are seeing rehabbing in a major way, making housing more available throughout the city. This gives people efficient access to homes close to big employers downtown like Coke, CNN, and Turner. A half trillion dollar real estate market means Atlanta’s property value per capita totals over $1.04 million.

4. Riverside, California

Popular with millennials and those escaping skyrocketing costs of living in Los Angeles, one of Riverside’s draws is affordable housing. In fact, 21,000 people relocated to Riverside between 2010 and 2017. Besides affordability, Riverside’s growing economy and near-ideal weather are an attractive combo for homebuyers. You’re also relatively close to both the beach and the mountains when you need a change of scenery.

The median home value in Riverside is $365,000, which is positively cheap compared with nearby L.A.’s $668,000 and San Diego’s $594,000 medians. This gives homebuyers more access to starter homes which can help make buying a larger, family home easier down the road. Buying in Riverside means being part of a market with $1.46 million in real estate value per resident.

3. Miami, Florida

Miami’s reputation precedes it. There’s no end of what to do and see. It’s one of dozens of beach towns along the Florida coast that draws in young people for professional opportunities and excuses to party. Thankfully, the median home value of$297,000 makes Miami a surprisingly affordable city. At that price, the only way to go is up, and there’s definitely room to grow. The Miami real estate market is worth $774 billion.

As an international business hub, Miami offers a lot of opportunity in banking, tourism, and trade careers. That, combined with its colorful and spirited nightlife makes Miami an ideal spot to buy real estate. After all, they’re not making any more coastal property.

2. North Port, Florida

Nestled between Fort Myers and Sarasota, North Port is a great place to live in Florida because of its laid back, suburban feel. Attractive to retirees, the median home value in North Port is $244,000 while the real estate value per resident is $1.89 million. In addition to having affordable home prices, the city also has excellent schools and a low crime rate.

For an in-town experience, make a trip to the Warm Mineral Springs. It will take years off your appearance and refresh you for your work week. With opportunities for skilled workers and professionals, the city’s quality of life helps make career options in North Port even more appealing.

1. Naples, Florida

Topping our list is another beachside town in Florida. With an adorable and historic downtown and amazing ocean views, Naples is one of the wealthiest cities in the country. The city’s enormous $104 billion real estate market equals out to a staggering $4.7 million on a per resident basis. While stunning luxury homes show how high property values can go here, the median house price is only $329,000. Living in Naples is not out of reach even if you don’t have millions.

A melting pot of residents, Naples attracts singles, young couples, families, and seniors. It also has a lot of residents who only live there part-time, opting to settle in during the winter months to avoid the cold elsewhere. With continued job growth, thanks to growing tourism and retail sectors, Naples offers affordable housing and career opportunities in a city with a lot of long-term potential.

Top 50 Cities in America by Real Estate Value

Here are the 50 biggest cities in the U.S. by estimated total dollar value of all combined real estate.

| City | Total Real Estate Value | Median Home Value | Population (2019 estimate) | Real Estate Value per Resident | Excess Value Per Capita |

|---|---|---|---|---|---|

| New York | $2.84 Trillion | $501,000 | 8,336,817 | $340,418 | -$160,582 |

| Los Angeles | $2.29 Trillion | $668,000 | 3,979,576 | $575,187 | -$92,813 |

| San Francisco | $1.32 Trillion | $959,000 | 881,549 | $1,497,364 | $538,364 |

| Chicago | $906 Billion | $245,000 | 2,693,976 | $336,306 | $91,306 |

| Washington, D.C. | $826 Billion | $455,000 | 705,749 | $1,170,388 | $715,388 |

| Boston | $815 Billion | $498,000 | 692,600 | $1,176,725 | $678,725 |

| Miami | $774 Billion | $297,000 | 467,963 | $1,653,977 | $1,356,977 |

| Seattle | $700 Billion | $498,000 | 753,675 | $928,782 | $430,782 |

| Dallas | $628 Billion | $243,000 | 1,343,573 | $467,410 | $224,410 |

| Philadelphia | $577 Billion | $246,000 | 1,584,064 | $364,253 | $118,253 |

| San Jose, Calif. | $568 Billion | $1,100,000 | 1,021,795 | $555,884 | -$544,116 |

| San Diego | $564 Billion | $594,000 | 1,423,851 | $396,109 | -$197,891 |

| Houston | $535 Billion | $211,000 | 2,320,268 | $230,577 | $19,577 |

| Atlanta | $531 Billion | $227,000 | 506,811 | $1,047,728 | $820,728 |

| Riverside, Calif. | $485 Billion | $365,000 | 331,360 | $1,463,665 | $1,098,665 |

| Phoenix | $484 Billion | $276,000 | 1,680,992 | $287,925 | $11,925 |

| Denver | $439 Billion | $430,000 | 727,211 | $603,676 | $173,676 |

| Minneapolis | $383 Billion | $294,000 | 429,606 | $891,515 | $597,515 |

| Detroit | $348 Billion | $172,000 | 670,031 | $519,379 | $347,379 |

| Portland, Ore. | $319 Billion | $401,000 | 654,741 | $487,216 | $86,216 |

| Sacramento, Calif. | $318 Billion | $410,000 | 513,624 | $619,130 | $209,130 |

| Baltimore | $301 Billion | $284,000 | 593,490 | $507,169 | $223,169 |

| Tampa, Fla. | $286 Billion | $216,000 | 399,700 | $715,537 | $499,537 |

| Austin, Texas | $248 Billion | $323,000 | 978,908 | $253,344 | -$69,656 |

| Charlotte, N.C | $248 Billion | $223,000 | 885,708 | $280,002 | $57,002 |

| Orlando, Fla. | $233 Billion | $245,000 | 287,442 | $810,598 | $565,598 |

| Honolulu | $219 Billion | $705,000 | 347,397 | $630,403 | -$74,597 |

| Nashville, Tenn. | $209 Billion | $265,000 | 692,587 | $301,767 | $36,767 |

| St. Louis | $202 Billion | $162,000 | 300,576 | $672,043 | $510,043 |

| Las Vegas | $191 Billion | $278,000 | 651,319 | $293,251 | $15,251 |

| San Antonio | $187 Billion | $206,000 | 1,547,253 | $120,859 | -$85,141 |

| Providence, R.I. | $179 Billion | $300,000 | 179,883 | $995,091 | $695,091 |

| Pittsburgh | $172 Billion | $163,000 | 300,286 | $572,787 | $409,787 |

| Cincinnati | $167 Billion | $179,000 | 303,940 | $549,451 | $370,451 |

| Kansas City, Mo. | $164 Billion | $195,000 | 495,327 | $331,094 | $136,094 |

| Columbus, Ohio | $163 Billion | $207,000 | 898,553 | $181,403 | -$25,597 |

| Bridgeport, Conn. | $159 Billion | $410,000 | 144,399 | $1,101,116 | $691,116 |

| Virginia Beach, Va. | $155 Billion | $238,000 | 449,974 | $344,464 | $106,464 |

| Oxnard, Calif. | $148 Billion | $586,000 | 208,881 | $708,537 | $122,537 |

| Jacksonville, Fla. | $145 Billion | $213,000 | 911,507 | $159,077 | -$53,923 |

| Cleveland | $141 Billion | $151,000 | 381,009 | $370,070 | $219,070 |

| North Port, Fla. | $134 Billion | $244,000 | 70,724 | $1,894,689 | $1,650,689 |

| Milwaukee | $131 Billion | $238,000 | 590,157 | $221,975 | -$16,025 |

| Cape Coral, Fla. | $128 Billion | $218,000 | 194,495 | $658,115 | $440,115 |

| Raleigh, N.C. | $127 Billion | $271,000 | 474,069 | $267,893 | -$3,107 |

| Richmond, Va. | $124 Billion | $240,000 | 230,436 | $538,110 | $298,110 |

| Indianapolis | $122 Billion | $148,000 | 876,384 | $139,208 | -$8,792 |

| New Orleans | $110 Billion | $201,000 | 390,144 | $281,947 | $80,947 |

| Naples, Fla. | $104 Billion | $329,000 | 22,088 | $4,708,439 | $4,379,439 |

| Salt Lake City | $103 Billion | $312,000 | 200,567 | $513,544 | $201,544 |

Going from starter home to family home

Many cities attract potential home buyers for a number of reasons. When you’re thinking about purchasing your first home though, affordability ranks high on the list. Our list of best cities to buy real estate combines affordable housing with much higher real estate values per resident. This provides buyers a golden opportunity to trade up when it’s time to sell a home. It also helps build equity in a large and growing housing market.

Methodology

To determine the best cities to buy real estate, we used public tax assessor records and real estate listing data for residential houses in the largest 660 markets, provided by First American Data, population data from the U.S. Census Bureau and total real estate value estimates from Lending Tree.

While every city on this list demonstrates a valuable gap between median home value and real estate value per resident, they’re all above the national median price for a home, or just under $250,000.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.