Millennial Moving Trends Show COVID-19 City Flight Was Overhyped

As hybrid work becomes the new norm and amenities start reopening, younger Millennials will flock back to cities, but older Millennials will stay in the suburbs. We dive into how COVID-19 is affecting Millennial moving trends, but have a spoiler: there’s not much new here.

Takeaways:

- Millennials are moving out of cities (and to the suburbs), but this started before the pandemic

- Workers moving to the suburbs didn’t move too far expecting hybrid work schedules to pick up

- During the pandemic, older millennials and Gen X’ers cared about local schools and younger millennials cared about affordable starter homes and waiting for life to get back to normal

- Metro clusters will always persist

Remote work has become a dream come true for some people, but a nightmare for others. As the majority of Americans have gotten or scheduled their second dose of the COVID-19 vaccine, and the idea of returning to the office has become a reality, more support for both a metropolitan and suburban lifestyle is evident. That might mean fewer days at the office as a hybrid work schedule becomes the new norm, but the large cities that historically attracted highly skilled workers are coming back to life.

A year ago, we looked at biotech industry clusters around the U.S., and said that cities with strong healthcare and life science industries would remain attractive to live in for people in those growing industries. We predicted that it would take a very long time for biotech space with lab components to leave their current metros and develop in new ones, for large talent pools to migrate there, and that remote work is impossible for lab employees. UC Berkeley economist Enrico Moretti says that the same goes for other industries, like finance, and the top 10 metro areas in the U.S. account for 70% of all computer science inventors.

The academic term for the clustering of different industries in certain cities is called “agglomeration,” and it’s one of the most important concepts for understanding why this happens. History of economic geography shows the forces of agglomeration are very powerful, and there’s no reason the tendency to cluster should change post-COVID.

One of the main forces behind the growth of these clusters is that as employees leave large companies like Google and Microsoft, they start their own businesses in the same geographic area. In addition to that, they want to tap into the already specialized labor force.

The generational trends

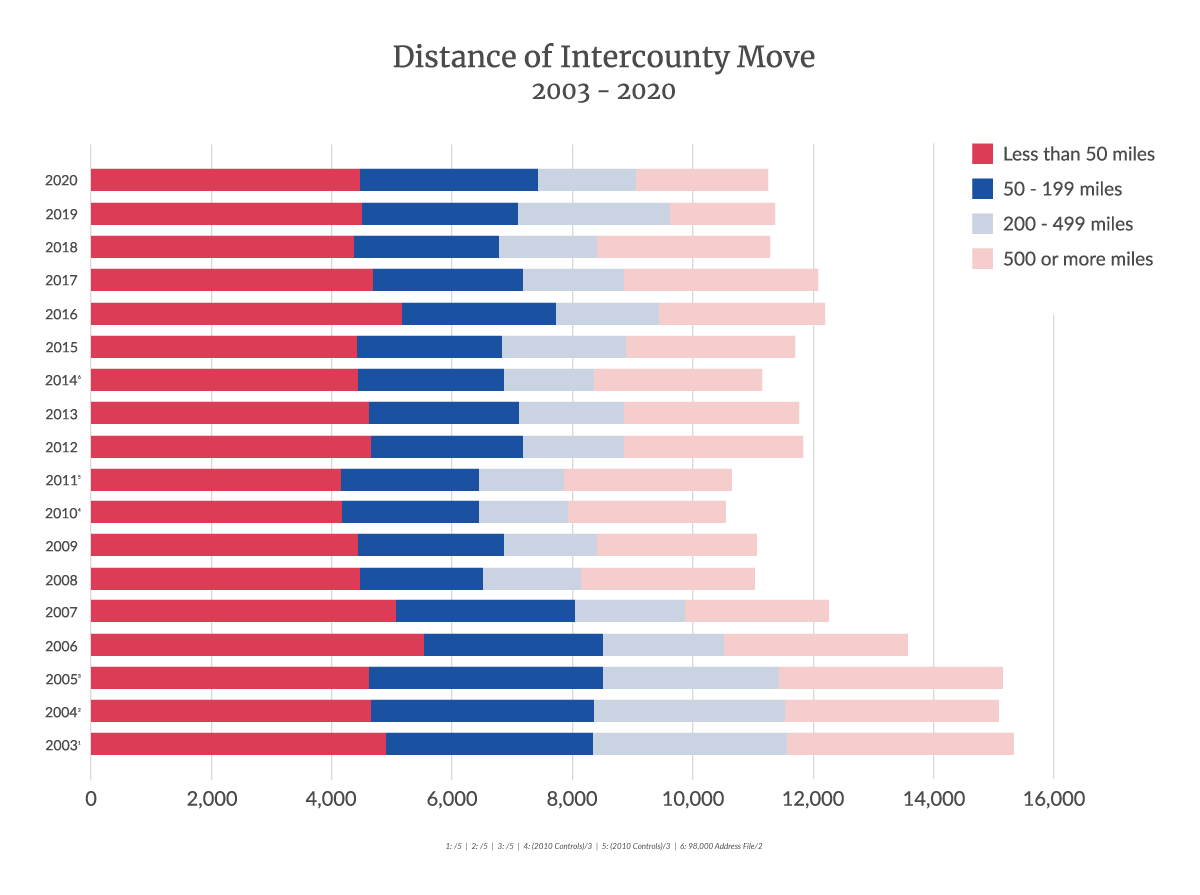

During the pandemic, more Millennials moved to the suburbs, but this shift began prior to COVID-19 as the bulk of them are easing into home-buying and family formation age. However, most workers didn’t go too far. Most professionals remained within driving distance of the city and many major companies, betting that a hybrid work schedule option is the new way normal.

Related: Should You Move to Suburbs?

The pandemic migration trends had a clear generational preference. The older Millennials and Gen X’ers cared about local schools and younger Millennials cared about affordable starter homes and waiting for life to get back to normal. Almost a year ago, we said that as things begin to open up and culture that attracts young white-collar workers to the city is back, they will once again see the attractiveness of condos and townhouses within walking distance of bars and restaurants. As soon as vaccine rollouts started, home prices in cities surpassed suburban and urban price growth.

The Baby Boomer impact

The Baby Boomers had a rough time during COVID-19. Older boomers had to figure out if retiring earlier than they originally anticipated is what they should do because their job could not be done remotely, some younger boomers had to face dealing with aging parents and adult kids at the same time amid the pandemic. But most had to make a decision whether to move, stay put, rent, or downsize in the near future. While their decisions will vary, the result is going to be the same: we will see a material increase in supply of homes in the next few years, which will be good news for Millennials looking to buy.

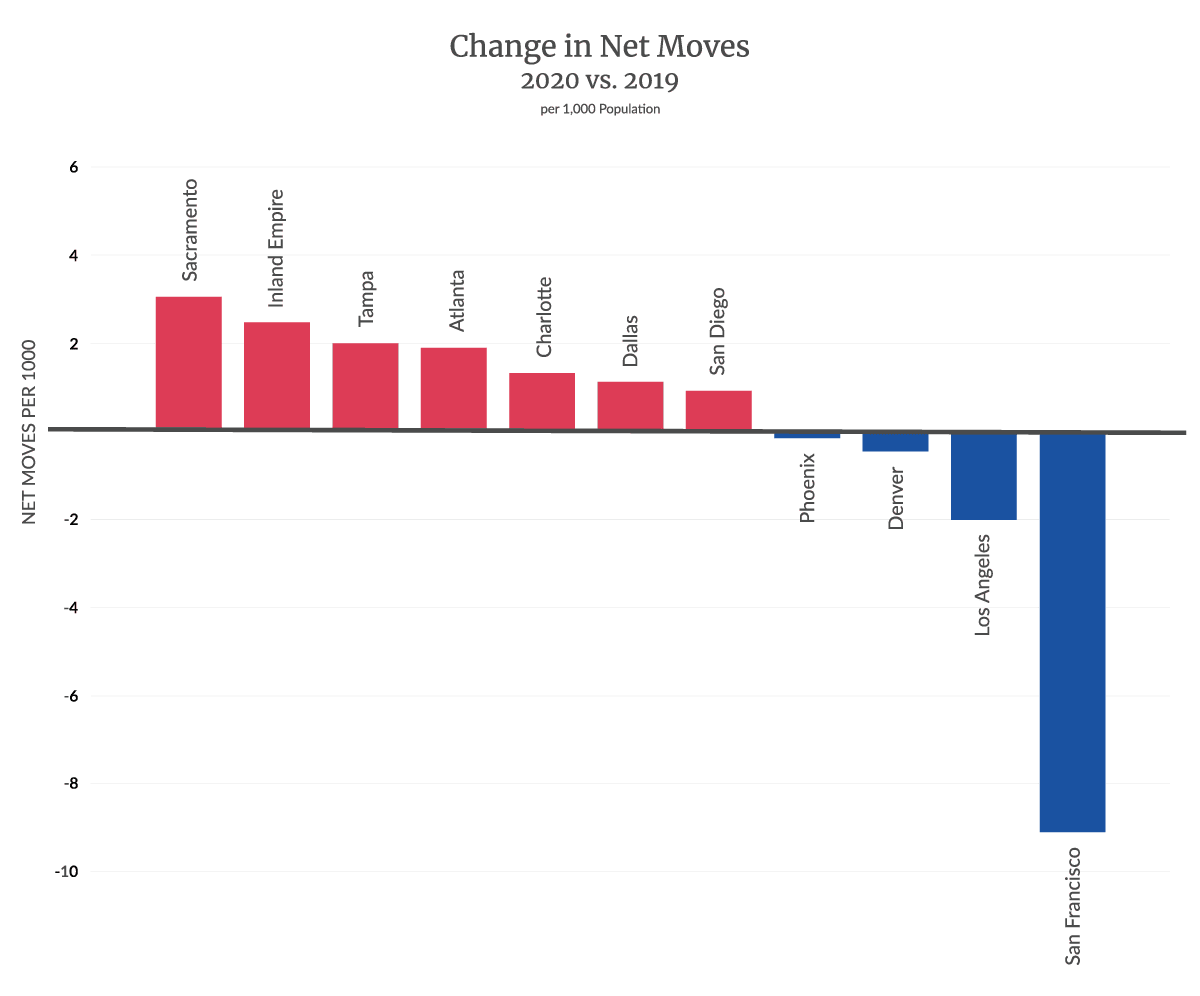

Geographic trends

Among the 30 largest U.S. metros, Sacramento saw the largest number of move-ins last year according to a migration study conducted by CBRE. The number of movers from San Francisco County to Sacramento County increased by 70% in 2020. A similar, albeit much smaller migration pattern, occurred in Los Angeles, where relocations to the Inland Empire rose 14%.

| Market | COVID-19 Impact New Moves Per 1,000 |

|---|---|

| Sacramento | 3.5 |

| Los Angeles | -2 |

| Inland Empire | 2.2 |

| San Diego | 0.9 |

| Tampa | 2 |

| Atlanta | 1.9 |

| Dallas | 1.1 |

| Charlotte | 1.3 |

| Phoenix | -0.1 |

| Denver | -0.4 |

| San Francisco | -9 |

| Mobility Period | Total Intercounty Movers/Thousand | Less than 50 miles | 50 to 199 miles | 200 to 499 miles | 500 miles or more |

|---|---|---|---|---|---|

| 2020 | 11,292 | 4,426 | 2,884 | 1,692 | 2,289 |

| 2019 | 11,401 | 4,510 | 2,569 | 1,651 | 2,670 |

| 2018 | 11,334 | 4,313 | 2,446 | 1,678 | 2,897 |

| 2017 | 12,033 | 4,781 | 2,414 | 1,788 | 3,051 |

| 2016 | 12,269 | 5,191 | 2,562 | 1,691 | 2,825 |

| 2015 | 11,746 | 4,419 | 2,449 | 2,004 | 2,875 |

| 2014 (98,000 address file)/2 | 11,112 | 4,467 | 2,396 | 1,515 | 2,733 |

| 2013 | 11,731 | 4,720 | 2,458 | 1,661 | 2,892 |

| 2012 | 11,842 | 4,762 | 2,444 | 1,623 | 3,013 |

| 2011 (2010 controls)/3 | 10,623 | 4,097 | 2,259 | 1,479 | 2,788 |

| 2010 (2010 controls)/3 | 10,549 | 4,118 | 2,251 | 1,523 | 2,658 |

| 2009 | 11,034 | 4,407 | 2,402 | 1,568 | 2,657 |

| 2008 | 11,009 | 4,449 | 2,112 | 1,610 | 2,838 |

| 2007 | 12,299 | 5,149 | 2,582 | 1,802 | 2,765 |

| 2006 | 13,690 | 5,595 | 2,910 | 2,092 | 3,092 |

| 2005 /5 | 15,287 | 4,657 | 3,752 | 3,007 | 3,870 |

| 2004 /5 | 15,171 | 4,665 | 3,722 | 3,186 | 3,598 |

| 2003 /5 | 15,356 | 4,953 | 3,407 | 3,177 | 3,819 |

COVID-19 had a lot of people thinking the urban centers were doomed. There are still headlines about pandemic migration, but census data indicates that all that moving around was mostly to the suburbs, not other states. The reason cities like New York and San Francisco have looked deserted during the pandemic is because many of the urban amenities have been shut down. The biggest cohort of urban outflow were well-educated affluent young adults. Once they feel safe from COVID-19 and the amenities re-open, we are going to see them rushing back to take advantage.

Ready to Get Started?

Sell as-is. Pay zero fees to Sundae. Move on your time. No repairs, cleanings, or showings.