Is the Housing Market Boom Over?

With interest rates rising, house sales are slowing. This has caused many people across the country to wonder if this is the end of the housing boom.

Interest rates continue to rise in 2022. As of early June, mortgage rates are 2 percentage points higher than at the start of the year. This ties back to the Fed’s promise to raise rates substantially throughout 2022 to combat inflation.

The question remains: how are rising interest rates impacting the housing market?

The Fed is trying to find its footing in this balancing act

The Fed will start reducing the size of its balance sheet on June 1. We generally have an idea of how rising interest rates impact the economy. What we don’t know is exactly what kind of implications the Fed’s promise to reduce its balance sheet will have when combined with rate hikes.

The Fed owns nearly $3 trillion in mortgage-backed securities (MBS). The higher the 10-year treasury yields that offer a risk-free rate of return, the less attractive these MBS are because they carry various risks.

Property purchases plummeted in April

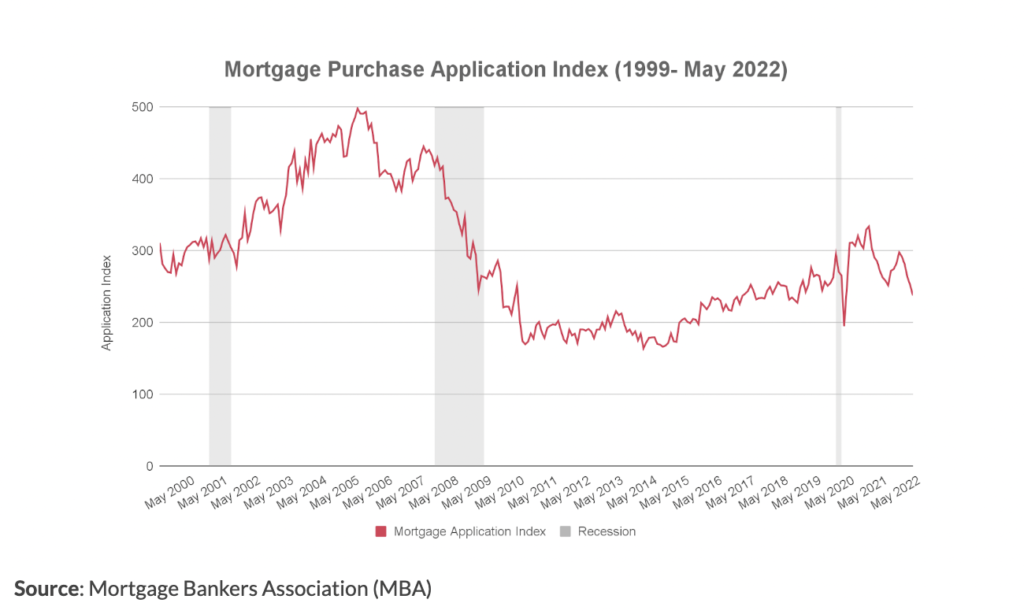

Meanwhile, the housing activity has been reflecting the impact of rising rates. April sales were based on contracts signed in March when 30-year mortgage rates saw their first hike, so the purchase application activity fell significantly.

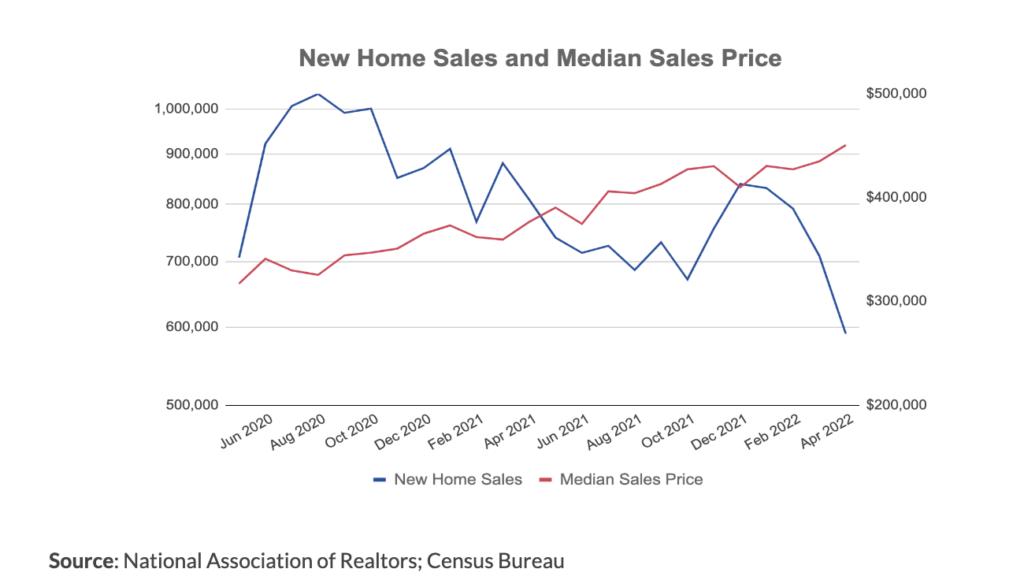

April’s new home sales dropped 7% month over month, and 27% year over year. It’s the lowest level since the onset of the pandemic in March of 2020. A lot of this is due to supply chain disruptions and material and labor shortages. However, it’s still worth noting.

Even so, the median home price continues to increase and so is the delta between the average and median new house price. The increase in this difference between the average and median price means builders shifted priorities. They began to focus on building more expensive luxury products and fewer entry-level homes. In effect, creating more demand for starter houses.

Flippers double down on starter homes

Fix and flip investors on the other hand, increased bidding on the entry-level homes, or as they like to call them, the bread and butter deals. While builders look to move-up buyers, the competition for entry-level homes has been heating up as these properties are always in high demand.

As the market changes, this is just one way that investors are showing their adaptability. There are opportunities in any market, it’s about finding the right strategy.

Discover nationwide properties you won’t find elsewhere

Find, win, and close on exclusive and vetted investment properties.